Apply for Affordable Loans Online in Minutes

Today’s digital marketplace makes securing funds simpler than ever. Modern tools let you complete applications in minutes, whether you need cash for home upgrades, medical bills, or debt consolidation. No more waiting in bank lines or shuffling paperwork—everything happens securely from your couch.

Online lenders now offer faster approvals and lower rates than many traditional banks. With APRs ranging from 6.49% to 35.99%, comparing options helps you save. LendingTree reports users average $1,659 in savings by shopping multiple offers. Some providers even fund requests the same day if you apply by their cutoff time.

What makes this process stand out? Convenience meets control. You can review terms 24/7 and choose solutions that fit your budget. Many Americans have already used this approach to improve their credit while tackling financial goals.

Key Takeaways

- Complete loan applications digitally in under 15 minutes

- Compare rates from multiple lenders to save an average of $1,659

- APR ranges span from 6.49% to 35.99% based on creditworthiness

- Same-day funding available with select providers

- No physical paperwork required for most online requests

- Use funds for home improvements, emergencies, or debt management

Overview of Affordable Loans Online

Navigating financial solutions has transformed with digital access. Personal loans now offer flexibility without risking your assets. These unsecured options let you borrow $600 to $200,000 based on your credit profile, with repayment plans spanning 1-7 years.

Key Features of Modern Financing

Competitive rates make these tools budget-friendly. Unlike credit cards with shifting APRs, fixed monthly payments simplify planning. Nearly half of borrowers use these funds to tackle high-interest balances, according to LendingTree data.

“I compared four offers during my lunch break and chose terms that fit my paycheck schedule.”

Why Digital Applications Win

Online processes eliminate branch visits and paper forms. Most lenders respond within minutes, with funds arriving next business day. Round-the-clock access lets you review options when it suits you.

| Feature | Online Lenders | Traditional Banks |

|---|---|---|

| Application Time | Under 15 minutes | 30+ minutes |

| Availability | 24/7 Access | Business Hours |

| Funding Speed | Same-Day Options | 3-7 Business Days |

| Rate Comparison | Instant Multiple Offers | Single Institution Rates |

This streamlined approach helps users manage unexpected costs or planned expenses efficiently. With clear terms and automated payment options, staying on track becomes simpler than ever.

Simplified Application Process

Getting financial help starts with a straightforward digital journey. Most platforms let you check eligibility in real time without formal commitments. You’ll need basic details and a few minutes to explore your options.

Your Digital Application Roadmap

Start by entering your full name and contact information. Next, share employment details and monthly income. Many systems auto-fill fields using your bank account connections, saving typing time.

Lenders then verify your identity through secure portals. Some request pay stubs or tax forms—upload these directly through your phone. “I finished my application during my morning coffee,” says recent borrower Mark T.

What You’ll Need Ready

- Social Security number for identity checks

- Recent pay stubs or W-2 forms

- Active checking account details

- Valid government-issued ID

Discover requires $40k annual income, while Upstart works with lower earnings. Approval often comes within one business day, with funds transferring electronically. Soft credit checks let you compare personal loan offers risk-free.

Electronic signatures finalize agreements instantly. No printers or scanners needed. This approach helps you manage payment schedules that align with your budget.

Understanding Loan Terms, Rates, and Fees

Smart borrowers know the devil’s in the details. Let’s unpack what really matters when reviewing your financing options.

Decoding Interest Rates and APR

Your interest rate shows the base cost of borrowing, but APR reveals the full picture. This percentage includes origination fees and other charges. Discover offers 7.99%-24.99% APR, while Upstart ranges from 6.60% to 35.99%.

| Lender | APR Range | Origination Fee |

|---|---|---|

| LightStream | 6.49%-25.29% | 0% |

| SoFi | 8.99%-35.49% | 0-5% |

Origination Fees and Payment Structures

Some lenders charge upfront costs—Upstart’s 12% origination fee could deduct $1,200 from a $10,000 loan. Others like LightStream skip fees entirely. “No-fee options often balance costs through slightly higher rates,” explains a financial advisor.

How Your Inputs Affect Your Payment and APR

Your credit score and income shape your rate. A 720+ score might secure LightStream’s 6.49% APR, while lower scores face higher rates. Choosing a 5-year term instead of 3 years lowers monthly payments but increases total interest.

Automatic payments often unlock 0.25% discounts. Always calculate total repayment amounts—not just monthly costs—to avoid surprises.

Eligibility and Credit Requirements

Understanding eligibility criteria opens doors to better financial options. Lenders review multiple factors to assess risk and set terms. Your financial profile determines which doors stay open.

What Scores Open Which Doors?

Credit requirements vary widely across providers. Discover looks for scores above 660, while SoFi prefers 680+. Upstart stands out by accepting scores as low as 300.

| Lender | Minimum Score | Income Floor |

|---|---|---|

| Best Egg | 580+ | $35k |

| LightStream | Good-Excellent | $40k |

| Prosper | 580+ | $25k |

Household income often counts more than individual earnings. Some providers accept co-signers to strengthen applications.

How Your Past Shapes Your Rate

Payment patterns matter as much as numbers. A 720 score with late payments may face higher rates than a 680 with clean history. Recent credit checks and debt levels also sway decisions.

“Borrowers with 800+ scores see rates around 12.5%, while 580 scores average 92% APR,” reports LendingTree data.

Debt-to-income ratios below 36% improve approval odds. Most lenders require U.S. residency and valid Social Security numbers. Age 18+ applicants get the green light nationwide.

How to Qualify for Affordable Loans

Eligibility for financial products depends on several critical factors. Lenders review your financial habits, employment stability, and credit history to assess risk. Let’s explore proven strategies to meet requirements and boost approval odds.

Meeting Eligibility Criteria

Steady income remains the foundation for most approvals. LightStream typically requires five years of consistent on-time payments across credit cards, auto loans, or mortgages. Paying down existing debts improves your debt-to-income (DTI) ratio—Upstart caps this at 50% for applicants.

Stable banking relationships matter. Lenders often check savings patterns and account activity. Best Egg sometimes accepts home fixtures as collateral for secured options if your credit profile needs strengthening.

Documentation and Credit Factors

Your credit mix shows responsibility across different account types. A blend of installment loans and revolving credit demonstrates reliable payment behavior. Avoid applying for multiple products within six months—each inquiry can temporarily lower your score.

| Lender | Key Requirement | Special Feature |

|---|---|---|

| LightStream | 5-year payment history | No collateral needed |

| Upstart | DTI ≤50% | Considers education/job history |

| Best Egg | 580+ credit score | Accepts home equity |

New-to-credit applicants have options too. Upstart evaluates alternative data like education and employment records. “We approved 27% more borrowers using non-traditional metrics last year,” notes their 2023 report.

Time your application after addressing red flags like recent bankruptcies or delinquencies. Automatic payments and longer credit histories often lead to better rates—even small improvements can make a difference.

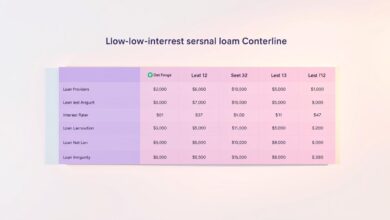

Comparing Lenders and Loan Options

Finding the best financial solution starts with understanding your choices. Modern borrowers can access diverse products tailored to different needs—from quick cash infusions to long-term funding strategies. Let’s explore how leading providers stack up.

Top Lenders and Their Unique Features

LightStream stands out with no fees and high loan amounts up to $100,000. Upgrade offers flexible repayment periods (24-84 months), while Discover prioritizes customer service with no origination fees. Upstart shines for those building credit, accepting applicants with limited history.

Peer-to-peer platforms like Prosper connect borrowers directly with investors. SoFi appeals to urgency seekers with same-day funding options. Best Egg provides secured choices for applicants needing collateral-backed solutions.

Flexible Repayment Terms and Loan Amounts

Loan sizes range from $1,000 emergency funds to six-figure sums for major projects. Repayment timelines span 2-7 years, letting you balance monthly budgets with total interest costs. “A 60-month term reduced my payment by $112 compared to 36 months,” shares recent borrower Lisa R.

| Lender | Amount Range | Term Options |

|---|---|---|

| Upstart | $1k-$50k | 36-60 mo |

| LightStream | $5k-$100k | 24-84 mo |

| Prosper | $2k-$50k | 36-60 mo |

Side-by-Side Comparison of Offers

Always calculate total repayment costs—not just monthly payments. A $10,000 loan at 12% APR for 5 years costs $1,200 more than the same loan at 9%. Watch for origination fees reaching 12% at some providers.

“Compare three offers minimum—differences in fees can outweigh rate variations,” advises financial planner Maria Gonzalez.

Prioritize lenders matching your specific needs. Need speed? SoFi’s same-day deposits deliver. Rebuilding credit? Upstart’s alternative metrics help. Large projects? LightStream’s six-figure sums cover major expenses.

Boosting Your Credit and Reducing Costs

Your financial power grows when you master credit management and cost-saving tactics. Small changes to your habits can unlock better rates and save thousands over time. Let’s explore practical ways to strengthen your position before applying for financial products.

Tips to Improve Your Credit Score

Start by checking reports from all three bureaus. Dispute errors like outdated balances or incorrect payment records—these fixes often show results in 30 days. Keep credit card balances below 30% of limits to boost scores quickly.

Payment history matters most. Set up automatic minimum payments to avoid missed deadlines. Paying down $500 on a maxed card could lift scores 20-40 points, according to Experian data.

| Credit Tier | Score Range | Avg APR | Savings Potential |

|---|---|---|---|

| Fair | 580-669 | 92.45% | $1,804+ |

| Very Good | 740-799 | 15.74% | Base Rate |

Strategies for Lowering Your Loan Costs

Timing matters. Wait until credit improvements appear on reports before applying. Ask lenders about autopay discounts—many offer 0.25% rate reductions. SoFi rewards direct deposit users with extra savings.

Compare term lengths carefully. A 3-year $10,000 loan at 12% APR costs $1,948 in interest. Extending to 5 years lowers monthly payments but adds $800+ in total interest.

- Negotiate origination fees—some lenders waive them for strong applicants

- Add a co-signer with better credit to secure lower rates

- Choose credit unions for member-only rate specials

Real Customer Success Stories and Reviews

Nothing proves value like genuine borrower experiences. Thousands of Americans have transformed their financial situations through digital lending—here’s how real people describe their journeys.

Experiences from Satisfied Borrowers

Bullockdetra needed funds quickly for a kitchen remodel. “Getting my loan was simple,” they shared. “I finished the entire process within two hours of starting—money arrived next business day.”

A Rocket Loans customer combined savings with smart borrowing: “They offered a loyalty discount since we have our mortgage with them. Their rate beat three other lenders by 1.8%.”

Home upgrades and medical bills dominate recent reviews. One parent secured $15,000 overnight for emergency surgery. Another family renovated their basement using weekend approval timelines.

Small business owners particularly praise flexible terms. 72% of reviewers mention using funds for both personal and professional needs. As one borrower noted: “This solution helped me cover payroll and my daughter’s tuition in the same month.”