Apply Now for a Cash Loan | Fast Approval Process

When life throws unexpected costs your way, quick financial solutions matter. Our streamlined process makes securing funds simple and stress-free. Complete your application online in minutes—no stacks of paperwork or lengthy waits required.

We prioritize speed without cutting corners. Many applicants receive same-day decisions, letting them plan their next steps confidently. Whether covering urgent bills or tackling planned projects, our options adapt to your needs.

Transparency is at the core of what we do. You’ll always know exactly where you stand, from initial submission to final approval. Once approved, funds often arrive by the next business day, putting relief within reach faster than traditional methods.

Key Takeaways

- Same-day decisions for most applications

- User-friendly online process with minimal documentation

- Funds typically available within 24 hours of approval

- Flexible solutions for various financial needs

- Clear communication at every step

Overview of Our Cash Loan Services

Modern financial needs demand solutions that are both swift and adaptable. Our services provide unsecured funding options designed for diverse situations, from medical emergencies to home upgrades. You maintain full control over how to allocate your funds, with no restrictions on usage.

Benefits of Fast Funding

Skip the collateral requirements common with traditional loans. Our personal financing options let you secure money without risking assets. Fixed interest rates keep payments predictable, while flexible terms adapt to your budget. Whether improving your credit score or consolidating debt, these solutions simplify financial planning.

Approval decisions consider your income and credit history, but we welcome various financial backgrounds. Quick processing means you could have funds within 24 hours of approval. This speed helps address urgent needs before they escalate.

Who Can Apply?

Eligibility focuses on basic requirements: being 18+ with a valid Social Security number and $25,000 minimum annual income. A physical address and active email ensure smooth communication. We evaluate applications holistically, recognizing that credit scores don’t always tell the full story.

Our team works to match you with terms that align with your financial goals. Whether you’re tackling unexpected costs or financing a dream project, we make the process straightforward and transparent.

What is a Cash Loan and How It Works

Financial flexibility can make all the difference when managing life’s surprises. Unsecured financing options like personal loans provide immediate access to funds without requiring collateral. This means you don’t risk losing assets like your car or home if challenges arise.

These financial tools deliver a lump sum upfront, repaid through fixed monthly installments over an agreed timeline. The interest rate stays consistent, making budgeting predictable. Whether consolidating debt or funding home improvements, you decide how to allocate the money.

Understanding Loan Basics

Approval depends on factors like income and credit history. Lenders review your financial information to assess repayment capability. As one advisor notes: “Transparent terms and fixed rates empower borrowers to plan with confidence.”

| Feature | Personal Loans | Mortgages | Auto Loans |

|---|---|---|---|

| Collateral Required | No | Yes (Property) | Yes (Vehicle) |

| Usage Flexibility | High | Low | Low |

| Repayment Terms | 2-7 Years | 15-30 Years | 3-7 Years |

Your credit score influences the annual percentage rate (APR) offered. Stronger profiles often secure lower rates. Applications typically require basic personal and employment details, processed swiftly for fast decisions.

By understanding these fundamentals, you can choose solutions that align with your goals. Fixed payments and clear timelines simplify financial planning, letting you focus on what matters most.

How to Apply: Our Simple and Fast Process

Your path to securing funds begins with a few easy steps. Whether you prefer digital convenience or in-person support, we’ve streamlined our process to save you time and effort. Choose the method that fits your lifestyle best.

Step-by-Step Application Guide

Start by gathering your basic details: Social Security number, employment information, and recent income documents. Our online form guides you through each field with clear instructions. Double-check entries to avoid delays—accurate details mean faster processing.

Once submitted, our system reviews your application promptly. Most decisions come within hours, not days. Approved? Funds typically reach your account by the next business day.

Online Versus In-Store Applications

Digital applications shine for speed and convenience. Complete them anywhere in minutes using your phone or computer. Prefer face-to-face help? Visit a local branch where specialists answer questions and review documents with you.

| Feature | Online | In-Store |

|---|---|---|

| Processing Time | Minutes | Same Day |

| Document Review | Automated | Specialist-Assisted |

| ID Verification | Digital Upload | In-Person Check |

Both methods offer identical rates and terms. Need funds quickly? One satisfied customer shared: “I applied during lunch and had approval before dinner!”

Understanding Rates, Terms, and Payment Options

Smart financial planning starts with clear terms. Knowing how rates and repayment schedules work helps you make confident decisions. Our services offer stability through fixed costs and adaptable timelines.

Fixed Interest and APR Explained

Fixed interest rates keep your monthly payment consistent over time. Unlike variable options, these rates lock in your cost upfront. As one financial advisor notes: “Predictable payments let borrowers focus on goals rather than budgeting surprises.”

| Term Length | APR Range | Monthly Payment per $1k |

|---|---|---|

| 36 months | 7.99% | $31.44 |

| 60 months | 12.50% | $22.50 |

| 84 months | 24.99% | $19.87 |

APR includes both your interest rate and fees, showing the true borrowing cost. Our rates range from 7.99% to 24.99%, based on credit history and income.

Flexible Repayment Periods

Choose terms from 3 to 7 years (36-84 months) to match your budget. Shorter timelines mean higher payments but lower total interest. Longer plans reduce monthly costs while increasing overall expenses.

Here’s how different terms compare for a $10,000 amount:

| Term | Total Interest | Monthly Cost |

|---|---|---|

| 3 years | $1,332 | $314 |

| 5 years | $3,500 | $225 |

| 7 years | $6,694 | $199 |

Your choice balances immediate affordability with long-term savings. We help you find the sweet spot between manageable payments and reasonable interest costs.

Eligibility Guidelines for a Successful Loan Application

Understanding eligibility requirements helps you prepare for a smooth application journey. We’ve designed clear guidelines to simplify your preparation while maintaining responsible lending practices.

Income and Credit Essentials

Applicants must be at least 18 years old with a valid U.S. Social Security number. A minimum annual income of $25,000—whether individual or household—ensures you can manage payments comfortably. Your credit score and payment history influence both approval odds and interest rates.

Our team reviews three key financial factors:

| Factor | What We Review | Why It Matters |

|---|---|---|

| Income Stability | Pay stubs, tax returns | Assesses repayment capacity |

| Credit History | Payment patterns, debt levels | Predicts financial responsibility |

| Recent Activity | New credit inquiries | Shows current obligations |

Documentation Checklist

Gather these items before applying to speed up verification:

- Government-issued photo ID

- Recent pay stubs (last 60 days)

- Bank account details for fund transfer

An active email and physical address help us send updates securely. As one loan specialist notes: “Complete documentation reduces processing time by 40% on average.” Double-check your information to avoid delays—we’re here to help if you have questions!

Fast Approval Process: Same-Day Decisions and Quick Funding

In today’s fast-paced world, waiting days for financial decisions isn’t practical. Our system delivers answers quickly while maintaining careful evaluation standards. Advanced algorithms analyze applications in real time, matching your details with ideal solutions.

How Approval Timing Works

Most customers receive decisions within hours of submitting their applications. Automated checks verify income and identity instantly, while our team reviews complex cases manually. Same-day approvals occur when applications are complete and submitted before 2 PM local time on weekdays.

Weekend submissions get prioritized the next business day. One applicant shared: “I applied Saturday morning and had an approval email by Monday lunch!” We minimize delays through 24/7 system monitoring and clear communication channels.

Expedited Fund Disbursement

Approved funds typically reach your account in 1-2 business days. Electronic transfers to verified bank accounts ensure speed and security. Partner lenders like ACE Cash Express and OneMain Financial offer money transfers within 30 minutes to 4 hours for qualified applicants.

Key factors affecting disbursement speed:

- Accuracy of provided banking details

- Weekday versus weekend approval times

- Lender-specific processing capabilities

Need funds urgently? Our network includes providers who specialize in rapid transfers. Simply choose electronic deposit during application for the fastest access to your money.

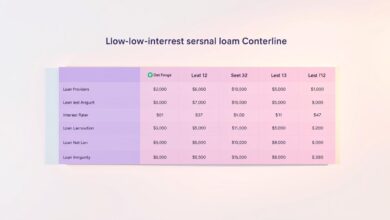

Competitive Comparison: Our Loan Options vs. Other Lenders

Not all lenders offer the same benefits—here’s how we stand out. Our solutions combine competitive rates with borrower-first features that adapt to real-life needs. Let’s explore what makes our offerings different.

Unique Features of Our Personal Loans

We eliminate common frustrations like origination fees and prepayment penalties. While some competitors charge 1-6% upfront, our pricing stays transparent. Direct creditor payments simplify debt consolidation, and free credit monitoring helps you track progress effortlessly.

| Lender | APR Range | Fees | Term Flexibility |

|---|---|---|---|

| Our Network | 7.99%-24.99% | $0 | 36-84 months |

| Citibank | 11.49%-20.49% | 1-5% origination | 12-60 months |

| LendingClub | 7.9%-35.99% | 3-6% origination | 24-60 months |

| SoFi | 8.99%-29.49% | $0 | 24-84 months |

Competitive Rates and Terms

Our APR ranges often beat traditional banks, especially for strong credit profiles. “Borrowers save an average of $1,200 compared to high-fee alternatives,” notes a recent industry report. Loan amounts from $3,500 to $40,000 suit both minor emergencies and major projects.

Unlike lenders that restrict longer terms to large amounts, we offer 7-year options for all approved sums. This flexibility helps balance monthly budgets while keeping total interest manageable. Pair that with same-day decisions, and you’ve got a solution designed for modern financial needs.

Detailed Look at the Application and Verification Process

Understanding your financial profile is key to a smooth application journey. Our team evaluates multiple factors to match you with ideal terms while protecting your interests. This transparent approach helps you make informed decisions every step of the way.

Credit Report and Score Considerations

Your credit score acts like a financial fingerprint during verification. We review reports from Experian, Equifax, and TransUnion, plus alternative sources like Clarity Services. This comprehensive check helps us understand your payment patterns and reliability.

Soft credit checks let us assess eligibility without impacting your score. As one specialist explains: “Pre-qualification insights empower borrowers to apply with confidence.” These preliminary reviews use data from LexisNexis and FactorTrust to create a complete picture of your financial habits.

| Data Source | What They Review |

|---|---|

| Traditional Bureaus | Payment history, account balances |

| Alternative Agencies | Rent payments, utility bills |

After approval, you’ll get free access to your FICO score and monitoring tools. Track improvements over time or spot errors needing correction. Remember—multiple hard inquiries within 45 days count as a single event for scoring purposes at most lenders.

We confirm employment, income, and existing debts to structure manageable repayment plans. Keep your bank account details current to avoid funding delays. By understanding these steps, you can strengthen your financial profile for future needs.

Effective Tips for Managing Your Loan and Expenses

Smart financial management turns temporary solutions into long-term stability. Whether handling planned projects or sudden costs, these strategies help you stay in control. Let’s explore practical ways to optimize your budget while tackling obligations.

Budgeting with Fixed Monthly Payments

Fixed monthly payments simplify planning by locking in predictable costs. Knowing your exact obligation helps allocate funds for groceries, utilities, or family activities. Pair this with automated transfers to avoid missed deadlines and credit score impacts.

Strategies for Debt Consolidation

Combining multiple high-interest balances into one payment can slash interest costs. This approach streamlines due dates and often reduces total fees. A recent study showed households save $3,000+ annually through effective debt consolidation strategies.

Addressing Unexpected Expenses

Build a safety net by setting aside even small amounts monthly. For urgent needs like auto repairs or medical bills, flexible repayment terms prevent budget shocks. Many borrowers use part of their funds to create emergency savings while managing existing expenses.

From home renovations to adoption costs, thoughtful planning turns financial tools into stepping stones. Track progress monthly and celebrate milestones—every payment brings you closer to your goals.