Bad Credit Loans Online – Quick Approval Options

When traditional banks say no, specialized financial solutions step in. Many Americans face challenges accessing funds due to past credit struggles, but modern lenders focus on your current needs rather than old mistakes. These services prioritize speed and accessibility, letting you apply from home without lengthy paperwork.

Approval decisions often come within 24 hours, providing urgent help when unexpected expenses arise. Magical Credit stands out by offering up to $20,000 while accepting various income sources like pensions or unemployment benefits. With a 4.3-star rating from 10,000+ customers, they’ve built trust through flexible solutions.

Responsible borrowing can actually help rebuild your financial standing. Timely payments get reported to credit bureaus, creating opportunities to improve your score over time. The digital process removes the stress of in-person meetings, putting you in control of your application timeline.

Whether it’s medical bills or car repairs, these tailored options bridge gaps when conventional lenders won’t. You’re not stuck – practical alternatives exist to help you move forward while working toward better financial health.

Key Takeaways

- Specialized lenders provide accessible options when traditional banks decline applications

- Approval decisions often occur within one business day for urgent needs

- Multiple income sources qualify, including non-traditional options

- Consistent repayments can help improve credit scores gradually

- Entire application process happens online for convenience

Overview of bad credit loans online

Modern financial tools offer solutions when past challenges affect borrowing options. Specialized products assess your current situation rather than focusing solely on previous setbacks. These options often feature faster decisions and more flexible criteria than standard bank offerings.

Understanding the Loan Process

Applying starts with a straightforward form requesting basic employment and income details. Lenders review your ability to repay rather than fixating on credit reports alone. Magical Credit uses advanced analysis that considers:

- Recent income patterns

- Bill payment consistency

- Financial behavior trends

Our Quick Approval Advantage

Traditional institutions often take weeks for decisions – we provide answers within one business day. This speed helps address urgent needs like emergency repairs or medical bills. Our system evaluates thousands of data points to create fair opportunities.

Timely repayments with these services can gradually improve your financial standing. Many customers appreciate the respectful approach that focuses on future potential rather than past difficulties. As one borrower noted, “This process gave me a real chance to recover without feeling judged.”

Streamlined Online Application Process

Today’s financial solutions prioritize simplicity over complexity. Magical Credit reimagines borrowing by cutting through red tape with a digital-first approach. Their system removes common frustrations like endless paperwork or strict office hours.

Simple 5-Minute Form

The application form asks only essential questions – no confusing financial jargon. You’ll provide basic contact details, income information, and banking specifics. No faxing documents or digging through file cabinets required.

One recent user shared: “I finished during my lunch break and had an answer before dinner.” The interface automatically saves progress if interrupted, letting you resume right where you left off.

24/7 Application Availability

Life doesn’t stick to 9-to-5 schedules, and neither does this service. Submit requests at 2 AM or Sunday afternoon – the system never closes. Mobile optimization means you can complete everything from your smartphone while waiting in line.

This accessibility breaks down barriers for those who can’t take time off work or lack transportation. Everything stays digital from start to finish, creating a paperless way to handle urgent needs. As one applicant noted, “It felt empowering to solve my problem without asking for time off.”

Flexible Repayment Terms and Responsible Lending

Financial flexibility becomes crucial when managing unexpected expenses. Magical Credit structures repayment plans with 12 to 60-month terms, letting you select timelines that match your budget. Their system adapts to different income cycles, whether you receive wages bi-weekly or earn through gig work.

Tailored Payment Schedules

Payment frequency options create breathing room for various financial situations:

| Frequency | Best For | Budget Benefit |

|---|---|---|

| Bi-weekly | Hourly workers | Aligns with paycheck deposits |

| Semi-monthly | Salaried employees | Matches bill due dates |

| Monthly | Contractors | Simplifies cash flow tracking |

One borrower shared: “Choosing semi-monthly payments helped me avoid overdraft fees – it just clicks with how I manage money.” Early repayment options let you save on interest without penalties.

Magical Credit evaluates applications carefully to prevent overborrowing. Approval depends on current income stability rather than past financial missteps. This approach ensures payments remain manageable, not stressful.

All fees and terms get explained upfront through simple charts – no hidden costs surprise borrowers later. As a company representative notes: “We succeed when our clients rebuild stability, not just when we issue loans.”

Eligibility Criteria and Approval Requirements

Meeting basic requirements opens doors to financial support when you need it most. Lenders focus on your current stability rather than past challenges. This approach creates fair opportunities while maintaining responsible practices.

Direct Deposit Income Verification

Steady cash flow matters more than perfect financial history. You’ll need either:

- 6+ months of consistent employment

- Government-provided income deposits

Accepted sources include unemployment benefits, pensions, and family support programs. Verification happens automatically through bank records – no pay stubs required.

| Income Type | Examples | Verification Method |

|---|---|---|

| Employment | Full-time, part-time, gig work | Bank deposit history |

| Government Support | EI, maternity leave, child tax | Deposit name coding |

| Retirement | Private pensions, CPP | Monthly deposit patterns |

Minimal Documentation Needed

Forget stacks of paperwork. You’ll provide:

- Government-issued ID

- 90-day bank statements

- Active email/phone number

Soft credit checks review your history without affecting scores. Only approved applications trigger deeper financial reviews. One applicant shared: “I expected endless forms, but they only asked what truly mattered.”

Every application gets personal attention from lending specialists. Past setbacks won’t define your outcome – current repayment capacity takes center stage. This human-centered approach helps create realistic solutions tailored to your situation.

Instant Decision and Fast Fund Delivery

Financial emergencies don’t wait for paperwork. That’s why modern lending solutions cut through delays with immediate responses. You’ll receive an approval decision the moment you submit your application – no anxious days spent wondering.

Seamless Bank Transfer Process

Once approved, funds race to your account faster than pizza delivery. Interac e-Transfer technology pushes money directly to your registered bank account within 5 minutes of signing the contract. One borrower exclaimed: “I refreshed my banking app twice and there it was!”

The system works 24/7 – midnight oil burns brighter when cash arrives during emergencies. Enable automatic deposits once, and future transfers happen without lifting a finger. Here’s how it simplifies urgent needs:

- No waiting games: Decisions made while you finish your coffee

- Digital handshake: Funds transfer starts immediately after approval

- Round-the-clock access: Receive money during holidays or weekends

This speed transforms stressful situations into manageable moments. Whether facing a broken furnace or surprise medical bill, solutions arrive before panic sets in. As one user put it: “Quick cash access let me focus on fixing the problem, not fretting about money.”

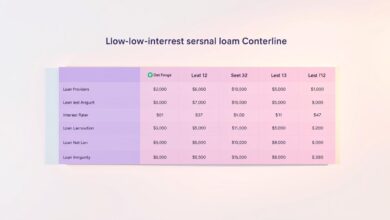

Understanding Interest Rates, Fees, and Loan Terms

Clear cost explanations build trust in financial decisions. Magical Credit prioritizes straightforward pricing models that help borrowers plan effectively. Their installment options feature APRs between 19.99% and 35%, with monthly rates starting at 3.9%.

Transparent Cost Breakdown

APR combines annual interest and fees into one percentage, while monthly rates show short-term costs. See how this works with a $1,500 loan example:

| Loan Amount | Term | Monthly Rate | Total Interest |

|---|---|---|---|

| $1,500 | 12 months | 2.9% | $525 |

This means repaying $2,025 total – no hidden charges added later. Factors influencing your specific rate include:

- Payment history consistency

- Current income stability

- Requested repayment timeline

Early payoffs stop future interest charges. One customer shared: “Paying my balance six months early saved me $217 – they didn’t penalize my initiative.”

Compared to credit cards averaging 24.99% APR, these structured options often cost less over time. All terms appear in bold print before signing, with specialists available to explain details. As the company states: “Surprise fees damage relationships – we build ours on clarity.”

Comparing bad credit loans with Traditional Options

Understanding different financial products helps make smarter choices during tough times. While traditional options exist, modern alternatives often provide better flexibility for those rebuilding stability.

How They Differ from Payday Loans

Payday loans typically demand full repayment within weeks, creating pressure during tight budgets. These short-term solutions often carry APRs exceeding 400%, trapping borrowers in debt cycles. Many states now limit these practices due to consumer protection concerns.

Specialized installment options offer longer repayment periods – sometimes years rather than days. Lower interest rates and structured payment plans help manage costs without surprise fees. Timely payments also contribute to credit improvement, unlike most payday arrangements.

Approval processes differ significantly. Payday loans rarely check repayment capacity, while responsible lenders verify income stability. This careful approach prevents overborrowing and supports financial recovery.

Choosing between options impacts both immediate needs and long-term goals. While payday loans provide instant cash, installment solutions create breathing room for sustainable progress. As one financial advisor notes: “The right choice today can open doors to better opportunities tomorrow.”