Best Loan Companies for Personal Loans in US

Choosing the right financial partner for your borrowing needs can be challenging. With countless lenders offering personal loans, it’s easy to feel lost in a sea of options. Our team analyzed top providers across the U.S., comparing rates, terms, and customer experiences to simplify your search.

This guide highlights institutions that excel in transparency and flexibility. Whether you prefer traditional banks, digital platforms, or credit unions, we’ve identified solutions for various credit scores and financial goals. Many lenders now offer same-day approvals and customizable repayment plans.

We prioritized companies with clear fee structures and responsive support teams. From debt consolidation to emergency expenses, the right loan can help you regain financial control. Our research covers everything from minimum credit requirements to special perks like rate discounts.

Key Takeaways

- Top lenders offer rates as low as 5.99% APR for qualified borrowers

- Online platforms often provide faster funding than traditional banks

- Credit unions may offer better terms for members with fair credit

- Pre-qualification tools help check rates without affecting your score

- 24/7 customer support is available through leading digital lenders

Understanding your credit profile helps narrow down suitable options. Let’s explore lenders that balance competitive pricing with exceptional service for your next financial move.

Introduction to Personal Loans in the United States

When life throws unexpected expenses your way, having access to flexible funding solutions can be a game-changer. Millions of Americans turn to personal financing options to bridge gaps in their budgets or tackle major purchases. Let’s break down how these tools work and why they’ve become so popular.

What Are Personal Loans?

A personal loan gives you a lump sum of money upfront, which you repay through fixed monthly installments. This structure helps eliminate surprises—you’ll always know exactly when your debt will be paid off. Whether you’re renovating a kitchen or covering vet bills, these loans adapt to your needs without collateral requirements in many cases.

Benefits of Secured and Unsecured Options

Secured versions use assets like savings accounts to back your borrowing. This often means lower interest rates and higher approval odds, even with average credit. Unsecured options skip collateral but rely more on your financial history. Both types help consolidate high-interest debt into single manageable payments.

Choosing between them depends on your priorities. Need cash fast without paperwork? Unsecured might suit you. Want to save on interest over time? Secured could be smarter. Either way, modern lenders make it easy to compare terms online before committing.

Understanding the Modern Lending Landscape

The way people access funds has transformed dramatically. Digital innovation reshapes how financial solutions reach customers, blending speed with smart decision-making. Borrowers now experience streamlined processes that respect their time while maintaining strict security standards.

Fast Funding and Quick Lending Decisions

Algorithm-driven systems analyze applications faster than ever. Many providers deliver approval responses within 15 minutes—a process that once took weeks. This efficiency helps address urgent expenses without delay.

Electronic transfers now push funds to accounts in one business day. Some lenders even complete transactions before lunchtime. These advancements eliminate the time-consuming paperwork that frustrated previous generations of borrowers.

Soft credit checks let you explore options risk-free. You can compare rates from multiple sources without dinging your score. This transparency empowers smarter financial choices tailored to your unique situation.

Round-the-clock availability means no waiting for business hours. Whether you apply at dawn or midnight, automated tools work nonstop. Dedicated support teams stand ready to clarify terms or troubleshoot issues.

Modern lending platforms cater to diverse credit histories. They balance rapid service with responsible practices, creating opportunities for more people to secure necessary funds. This evolution makes financial assistance both accessible and efficient.

Evaluating Your Credit Score and Its Impact on Loans

Your financial fingerprint matters more than you think. Lenders use your credit score like a report card to assess risk and set terms. Knowing how different checks work helps you shop smarter.

Soft Credit Checks vs Hard Credit Checks

Soft credit inquiries act like financial glances. They let lenders peek at your history without leaving marks. Use these when comparing offers—they won’t impact credit scores or show up on reports.

Hard credit checks dig deeper. These formal reviews occur during final approvals and can lower your score temporarily. Multiple hard pulls in 45 days might flag you as debt-hungry to creditors.

How Credit Scores Shape Loan Terms

Your three-digit number unlocks doors. Scores above 720 often secure the best rates—sometimes half what others pay. A 650 score might still qualify you, but expect higher costs over time.

Consider this: improving your credit by 50 points before applying could save $8,000 on a $20,000 loan. Monitoring tools help track progress without triggering hard credit checks.

Navigating the Loan Application Process

Modern borrowers enjoy more choices than ever when initiating financial requests. Whether you’re tech-savvy or prefer human interaction, today’s options adapt to your lifestyle while protecting your financial health.

Three Paths to Start Your Journey

Digital platforms let you complete an application in under 10 minutes. Upload pay stubs or bank statements directly through secure portals. Many systems provide instant updates through text alerts.

Phone consultations work well for complex situations. Representatives explain fine print like prepayment penalties while you multitask. “We guide customers through every field on the application,” says a major lender’s service manager.

Local branches remain popular for hands-on help. Advisors often spot opportunities you might miss online, like loyalty discounts or bundled services.

Smart Steps Before Submitting

Pre-approval tools let you explore rates without impacting credit. These soft checks reveal realistic amounts and terms based on your income and existing debts.

Gather these essentials beforehand:

- Recent pay stubs (last 30 days)

- Government-issued ID

- Utility bills for address verification

Top lenders now accept smartphone photos of documents. This shift slashes processing time from weeks to days. Remember: Complete applications get fastest approvals while protecting your credit score from unnecessary hard inquiries.

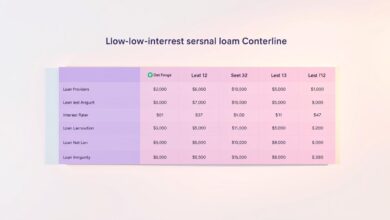

Top Loan Companies Offering Personal Loans

Smart borrowers compare financial tools like chefs select ingredients—matching specific needs with precise solutions. Let’s explore two popular choices that serve different money management goals.

Comparing Line of Credit and Secured Loan Options

A line of credit works like a financial safety net. You get approved for up to $10,000 but only pay interest on the amount you use. This works well for ongoing projects or unpredictable expenses.

| Feature | Line of Credit | Secured Loans |

|---|---|---|

| Maximum Amount | $10,000 | $25,000 |

| Interest Charged | Only on used funds | Full loan amount |

| Collateral Needed | No | Yes (car, savings) |

| Best For | Flexible spending | Large one-time costs |

Secured options often provide better rates since they’re backed by assets. A $25,000 loan with fixed payments helps budget-conscious borrowers avoid surprises.

Understanding Interest Rates and Payment Plans

Your credit score acts like a financial thermostat—it regulates the heat of your borrowing costs. Scores above 700 might secure rates as low as 8.99% APR, while fair credit could mean 25%+.

Consider these factors affecting interest rates:

- Payment history (35% of score)

- Debt-to-income ratio

- Loan term length

Many lenders now offer bi-weekly payments or seasonal pauses. One major provider reports: “Over 60% of borrowers customize their repayment schedules.” Always confirm fee structures before committing.

Features and Benefits of Leading Loan Providers

Top financial partners now offer more than quick cash—they provide tools that protect your life plans and adapt to changing circumstances. These innovations turn standard agreements into customized support systems.

Optional Loan Protection and Flexible Repayments

Unexpected events don’t have to derail your finances. Many providers offer optional safeguards that cover payments during job loss or medical crises. Most process claims within 72 hours, giving customers fast loan help when they need it most.

Repayment flexibility keeps budgets breathing. Adjust due dates, skip a payment, or reduce amounts temporarily. One lender notes:

“Over 40% of borrowers use our hardship options annually—we’re here to help, not penalize.”

Digital tools empower smarter money management. Track your credit score through lender apps, access free financial courses, or chat with advisors 24/7. Automatic payment discounts reward consistent users, while early payoffs save interest.

These features show how modern loan help extends beyond transactions. Providers invest in customers’ long-term success, blending security with adaptability for every life chapter.

Digital Tools and Account Management Features

Managing your finances now fits in your pocket. Modern lenders provide robust platforms that turn smartphones into financial command centers. These tools eliminate branch visits while keeping your money moves secure and transparent.

Control at Your Fingertips

Online dashboards display balances, due dates, and payment history instantly. One user shared:

“I adjusted my payment date during lunch break—no calls needed.”

Real-time updates help you avoid surprises and plan smarter.

Mobile apps send alerts for upcoming bills or account changes. You can approve transactions while waiting in line or review statements during commutes. This time-saving approach works whether you prefer Android or iOS.

| Feature | Online Portals | Mobile Apps |

|---|---|---|

| Payment Methods | Bank transfers, cards | + Cash locations |

| Notifications | Email only | Push alerts |

| Document Access | Full statements | Receipt snapshots |

| Support | Live chat | Video calls |

Need to send paperwork? Snap photos of pay stubs through the app. Many platforms store tax documents securely—no more digging through filing cabinets. Automatic payments protect your credit score from missed deadlines.

Prefer cash payments? Over 15,000 retail partners accept deposits nationwide. Digital receipts arrive instantly, creating a paperless way to track expenses. Support teams respond faster through in-app messaging than traditional phone queues.

These innovations transform how Americans handle their money. As one financial advisor notes: “Clients who use digital tools repay 22% faster on average.” Whether you’re tech-shy or a smartphone pro, these features adapt to your way of life.

Customer Reviews and Real-World Experiences

Real borrower stories cut through the marketing noise better than any brochure. People share their wins and struggles with financial products, giving you unfiltered perspectives on what works. These accounts reveal patterns you won’t find in rate tables or FAQ pages.

Testimonials Highlighting Fast Funding

Speed matters when facing urgent expenses. One parent shared:

“I received the cash for my daughter’s medical bill before my lunch break ended—no paperwork delays.”

Modern systems now move funds in minutes, not days. Over 60% of positive reviews mention same-day transfers as their top reason for recommending a provider.

Service quality shines through in stressful moments. Borrowers praise representatives who explain terms without jargon. “They treated my fair credit score as an opportunity, not a setback,” noted a recent review. This personalized approach builds trust during vulnerable financial moments.

Constructive feedback helps set realistic expectations. Some users wish for clearer fee breakdowns or better mobile app navigation. However, most agree that quick access to funds outweighs minor inconveniences. As one borrower put it: “When your car breaks down, you care about getting back on the road—not app colors.”

These stories highlight a key truth: the best financial partners balance speed with empathy. Whether consolidating debt or covering emergencies, real experiences show what “fast” truly means when cash can’t wait.

Securing Funding Without Impacting Your Credit

Getting funds quickly shouldn’t mean sacrificing your financial future. Many worry that exploring options might lower their scores, but smart strategies exist. Pre-approval processes let you check offers while keeping your credit report intact.

Protecting Your Credit Through Pre-Approval

Soft credit checks give you power to compare rates without penalties. This approach works for both short-term needs like payday loans and longer installment loans. You’ll see realistic terms based on your income and history—no guesswork required.

Lenders using this method often provide decisions in minutes. For repeated comparisons, stick with providers that don’t run hard checks until final approval. This keeps your score stable while you find the best fit for your budget.

Whether considering payday loans for emergencies or installment loans for planned expenses, transparency matters. Always review agreement details before proceeding to ensure fees and timelines align with your repayment capacity.