Discover the Best Home Equity Loan Rates Today

Unlocking the value of your property can help you achieve major financial goals. With average borrowing costs at 8.26% as of June 2025, tapping into your ownership stake offers a smarter alternative to high-interest credit cards or personal loans. The current market provides stable opportunities, thanks to predictable policies from the Federal Reserve.

Shorter-term options like 10-year agreements hover near 8.41%, while 15-year terms average slightly lower at 8.35%. These figures reflect a balanced environment where lenders compete to offer attractive terms. Whether you’re renovating, consolidating debt, or funding a large expense, understanding today’s landscape ensures you make confident decisions.

This guide simplifies the process of comparing offers from top providers. You’ll learn how to qualify for the most competitive deals and tailor solutions to your unique needs. Even if you’ve borrowed against your property before, fresh strategies could save you thousands over time.

Key Takeaways

- Average borrowing costs sit at 8.26%, with rates ranging from 5.49% to 10.47%

- Federal Reserve policies create a stable environment for long-term planning

- Shorter terms (10-year) currently have slightly higher averages than 15-year options

- Competitive offers are available for renovations, debt consolidation, and major expenses

- Comparing multiple lenders helps secure personalized terms and savings

Introduction to Home Equity Loan Products

Your property’s value isn’t just about where you live—it’s a financial resource. Equity grows as you pay down your mortgage or when market prices rise. This built-up value can become accessible cash for important expenses.

Understanding Your Property’s Financial Potential

Let’s break it down: If your house is worth $350,000 and you owe $280,000, you’ve got $70,000 in usable funds. Lenders typically let you borrow up to 85% of that amount. Here’s how it works:

| Property Value | Mortgage Owed | Available Equity | Accessible Funds |

|---|---|---|---|

| $350,000 | $280,000 | $70,000 | $56,000 |

This secured financing option often beats credit cards or personal loans because it’s backed by real estate. Fixed payments and potential tax perks for renovations make budgeting simpler.

Why This Option Stands Out in Finance

Two key factors drive its popularity: flexibility and cost-effectiveness. Funds can cover anything from kitchen remodels to college tuition, while rates stay lower than unsecured alternatives. As property values climb nationwide, more owners are discovering this smart way to fund goals without high-interest debt.

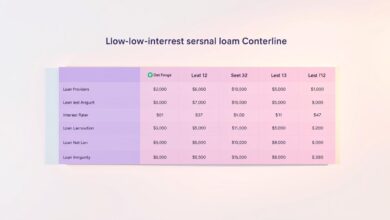

Current Home Equity Loan Rates from Top Lenders

Comparing offers from leading financial institutions reveals significant differences in borrowing costs. Major players like Achieve and SoFi now provide starting APRs below 7%, creating opportunities for substantial savings. Your financial profile and property value determine where you’ll find the best match.

Featured Lender Comparisons

Top institutions structure their deals differently. Achieve leads with 6.74% APR for amounts up to $300,000, requiring 20% equity retention. SoFi extends higher limits ($350,000) at 6.99% APR while allowing more leverage. For military families, Navy Federal stands out with 100% combined loan-to-value ratios.

| Lender | APR | CLTV | Amount Range |

|---|---|---|---|

| Achieve | 6.74% | 80% | $15k-$300k |

| SoFi | 6.99% | 85% | Up to $350k |

| Navy Federal | 7.34% | 100% | $10k-$500k |

| US Bank | 7.65% | 60% | $50k-$99k |

Rate Types and Credit Considerations

Most institutions offer fixed-rate options, locking in predictable payments. Variable-rate products exist but remain less common. Your credit score dramatically impacts approvals—680+ typically secures prime offers, though some lenders consider scores near 600.

Loan-to-value ratios range from 60% to 100% across providers. Higher ratios mean accessing more property value, but often come with stricter income verification. Always compare multiple proposals—a 1% rate difference can save $8,400 on a $150,000 balance over seven years.

Understanding the Basics of Home Equity Loan Rates

Securing favorable terms for your property’s value starts with understanding key financial mechanics. Unlike traditional mortgage rates tied to long-term bonds, these borrowing costs respond quicker to central bank decisions.

How Rates Are Determined

Lenders set terms using three main levers. The Federal Reserve’s benchmark rate—currently stable at 4.25%-4.50%—forms the foundation. Financial institutions then adjust based on their funding needs and risk assessments.

Your financial profile acts as the final piece. A 760 credit score could secure rates 1.5% lower than someone at 650. Loan amounts under $50,000 often carry higher costs due to fixed processing fees.

Impact of Credit Profiles and Economic Shifts

Economic uncertainty creates rate fluctuations. During inflationary periods, lenders might add 0.75%-1% to protect against currency devaluation. Housing market trends also matter—rising property values sometimes lead to better terms.

Recent Fed policies have created predictable conditions. As one banking executive noted, “We’re seeing the most stable environment since 2020 for fixed-rate products.” This stability helps borrowers compare offers confidently.

Features and Benefits of Home Equity Loans

Financial flexibility meets long-term stability with fixed-rate borrowing solutions. These products stand out for their structured approach to managing large expenses while maintaining budget predictability.

Stability Meets Customization

Fixed-rate options lock in your costs for the entire repayment period. Terms typically span 5-20 years, letting you match timelines with specific goals like college funding or kitchen upgrades. Monthly amounts stay identical, eliminating surprises from market shifts.

Many institutions now offer conversion features on variable products. You might start with lower initial costs, then switch portions to fixed terms later. This hybrid approach balances short-term savings with long-term security.

Lump-sum funding gives immediate access to your approved amount. Unlike credit lines requiring repeated draws, you receive everything upfront for planned projects. Each payment reduces both principal and interest, ensuring debt-free status by your chosen end date.

As one financial advisor notes: “Structured repayment plans help clients avoid the revolving debt trap common with credit cards.” This disciplined approach proves particularly valuable for multi-year financial strategies.

Qualifying for the Best Home Equity Loan Rates

Securing optimal terms for borrowing against your property requires meeting specific financial benchmarks. Lenders evaluate three core areas: your payment history, available ownership stake, and income stability.

Credit Requirements and Down Payment Essentials

Credit scores act as your financial passport. Most institutions prefer scores above 680 for prime offers, though some accept 600+ with adjusted terms. Consider this rate comparison:

| Credit Tier | Score Range | Typical APR |

|---|---|---|

| Excellent | 740+ | 6.74%-7.25% |

| Good | 680-739 | 7.50%-8.90% |

| Fair | 600-679 | 9.00%-12.00% |

Ownership stake matters equally. You’ll need at least 20% value difference between your property’s worth and existing mortgage balance. For a $400,000 residence with $300,000 owed, your accessible funds would be $80,000 (80% of $100,000 equity).

Stress Tests and Debt-to-Income Ratios

Lenders verify repayment capacity through two filters. First, your total monthly obligations (including the new payment) shouldn’t exceed 45% of gross income. Second, they test affordability at rates 2% higher than your actual terms.

“We want to ensure borrowers can handle unexpected financial shifts,” explains a major bank’s underwriting manager. Prepare recent pay stubs, tax returns, and mortgage statements to streamline approval. Organized applicants often secure better terms by demonstrating financial responsibility upfront.

HELOC vs. Home Equity Loan: Product Roundup Comparison

Choosing between flexible credit access and predictable payments depends on your financial needs. Two popular options let you leverage property value differently—each with unique structures and repayment terms.

Flexible Credit Lines vs Fixed Funds

HELOCs work like reusable credit cards tied to your property. You can borrow up to 65% of your residence’s value during a 5-10 year draw period, paying only interest initially. Need $15,000 for repairs now and $10,000 later? Tap your line as expenses arise.

Fixed-rate alternatives provide one lump sum upfront. Payments start immediately, combining principal and interest. This works best for single projects like roof replacements where costs are known. “The right choice depends on whether you need a financial safety net or a completed project budget,” notes a lending specialist.

Rate Structures and Repayment Phases

Most equity lines use variable rates—currently averaging prime + 0.5%. This means monthly costs can rise if the Fed increases benchmarks. Fixed options lock in today’s rates but lack adaptability.

Consider these key differences:

- HELOC draw periods allow interest-only payments

- Fixed loans require full repayment within 5-20 years

- Combined mortgage/HELOC setups access 80% property value

- Stand-alone lines cap at 65% value access

Reborrowing from a credit line saves application hassles but requires discipline. Fixed sums create automatic debt reduction through structured payments. Match your selection to spending patterns and risk tolerance.

Navigating Market Trends and Economic Updates

Economic shifts are reshaping borrowing strategies across North America. While the Bank of Canada held its key interest rate at 2.75% in June 2025, U.S. tariff policies continue creating ripple effects. These cross-border developments influence financing costs and consumer confidence in neighboring markets.

Recent Rate Adjustments and Cross-Border Effects

Seven consecutive cuts reduced Canada’s benchmark from 5% to 2.75%, stabilizing variable-rate products. This impacts U.S. lenders competing for cross-border clients, particularly with:

- Canadian 5-year bond yields dipping to 2.488%

- National property prices reaching $691,299 CAD

- May 2025 sales rising 3.6% monthly

American tariffs have intensified market uncertainty, though fixed-rate options remain popular. For HELOC users, Canada’s 4.95% prime rate offers clues about potential U.S. payment adjustments if Fed policies shift.

Smart borrowers monitor these trends when planning major financial moves. Staying informed helps lock in favorable terms before mortgage rates respond to global economic pressures.