Easy Loans with Fast Approval and Low Rates Available

Financial needs don’t follow a schedule. When urgent expenses arise, having access to competitive rates and quick decisions matters. Partnering with lenders like LendDirect, Magical Credit, and My Canada Payday, we connect you to solutions that align with your situation – whether it’s a sudden repair or a planned home upgrade.

Our network specializes in rapid approvals, often delivering funds in 15 minutes. Need $1,500 by tomorrow? My Canada Payday’s streamlined process makes it possible. For larger projects, Magical Credit offers up to $20,000 even with imperfect credit histories. No lengthy paperwork or hidden fees – just straightforward terms designed for real-life needs.

Apply from your home today and explore options tailored to your budget. LendDirect’s pre-approval checks won’t affect your credit score, while flexible repayment plans keep stress low. We prioritize transparency so you can borrow confidently, knowing exactly what to expect.

Key Takeaways

- Receive lending decisions in minutes with no credit impact for pre-approval checks

- Access amounts from $1,500 payday advances to $20,000 personal loans

- Options available for all credit types, including challenging financial histories

- Complete applications remotely from any location with internet access

- Secure electronic transfers deliver funds as fast as 15 minutes post-approval

Overview of Easy Loans with Fast Approval and Low Rates

Modern financial solutions should adapt to your life, not the other way around. Our network reimagines borrowing by prioritizing flexibility where traditional institutions fall short. Whether you’re managing unexpected costs or funding important plans, we connect you with tools designed for real-world challenges.

What Sets Our Solutions Apart

Traditional banks often focus solely on credit scores, but our partners analyze your full financial picture. LendDirect, serving customers since 2016, exemplifies this approach with secured options up to $25,000 and revolving credit lines. Their assessment methods consider employment history, banking patterns, and repayment capacity alongside traditional metrics.

Income diversity matters in today’s economy. Magical Credit recognizes this by accepting government subsidies, freelance earnings, and temporary benefits as valid repayment sources. This flexibility helps borrowers who might otherwise struggle to qualify.

| Features | Our Network | Traditional Banks |

|---|---|---|

| Approval Speed | 15 minutes – 24 hours | 3-7 business days |

| Credit Requirements | Holistic review | Score-focused |

| Income Sources | 12+ accepted types | Salaried only |

| Loan Types | Secured/unsecured options | Limited variety |

| Transparency | No hidden fees | Complex fee structures |

Clear information forms the backbone of our service. Every agreement details rates, repayment schedules, and potential charges upfront. This transparency lets you make informed decisions without second-guessing terms.

Understanding Lending Options for Your Financial Needs

Smart borrowing begins with matching your situation to the right financial tools. Two popular choices – lines of credit and secured loans – serve different purposes depending on your goals and circumstances.

Flexible Credit vs. Collateral-Based Solutions

A line of credit works like a financial safety net. LendDirect offers up to $10,000 available through online, phone, or branch applications. You only pay interest on what you use, making it ideal for ongoing needs like car repairs or covering bills between paychecks.

For larger projects exceeding $15,000, secured options using vehicle collateral might fit better. These loans provide up to $25,000 through in-person evaluations at branches. The collateral often leads to better rates and higher approval chances, even with credit challenges.

| Features | Line of Credit | Secured Loan |

|---|---|---|

| Maximum Amount | $10,000 | $25,000 |

| Collateral Needed | None | Vehicle |

| Application | Online/Phone/Branch | Branch Only |

| Best For | Recurring needs | Major expenses |

| Repayment | Interest on used funds | Fixed monthly payments |

Both options let you check pre-approval without credit score impacts. A line of credit keeps funds ready in your account for unexpected costs, while secured loans offer structured terms for planned home improvements or debt consolidation.

Consider how quickly you need access and whether collateral makes sense for your situation. Our partners help you compare these loan options confidently, ensuring you choose what aligns with your financial roadmap.

The Easy Loans Application Process

Getting financial help shouldn’t feel like running an obstacle course. Our partners simplify borrowing through multiple pathways that respect your time and preferences. Choose the method that matches your comfort level while maintaining speed and security.

Three Pathways to Financial Support

LendDirect leads with flexible submission options:

- Digital convenience: Complete forms online in 5 minutes

- Voice guidance: Phone agents verify details verbally

- Face-to-face help: 38 branch locations nationwide

Magical Credit takes digital-first service further. Their system skips document uploads by connecting directly to income verification databases. No scanning pay stubs or bank statements required.

| Method | Time Required | Documentation | Decision Speed |

|---|---|---|---|

| Online | 5-7 minutes | Digital ID + income proof | Instant |

| Phone | 8-10 minutes | Verbal confirmation | 15 minutes |

| Branch | 20 minutes | Physical inspection | 1 hour |

From Submission to Funding

Approval triggers immediate transfer options. Most applicants receive funds through Interac e-Transfer within 15 minutes. Traditional bank deposits take 1-2 business days.

Secured applications need one extra step. Visit any partner branch for vehicle assessment. Representatives handle title transfers while explaining repayment terms.

Throughout the entire process, support teams answer questions via live chat or local phone numbers. Transparency remains our priority – you’ll always know what comes next.

Features That Make Our Loans Stand Out

Urgent expenses demand financial tools that match modern life’s pace. Our partners deliver critical advantages through technology-driven processes and clear terms.

Rapid 15-Minute Funding and Approval

LendDirect’s Interac e-Transfer system moves at your speed. Approved applicants often see money in their accounts within 15 minutes – faster than ordering pizza. Traditional lenders average 3-5 business days for fund transfers.

Electronic verification slashes processing time. Secure encryption protects your data while speeding up decisions. This efficiency helps when car repairs or medical bills can’t wait.

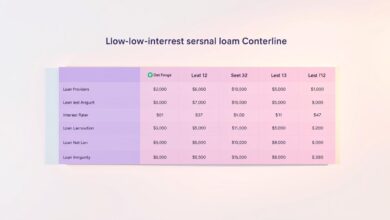

Low Rates and Transparent Fee Structures

Magical Credit offers APRs starting at 19.99%, with clear maximums at 35%. No guessing games – all costs appear upfront before signing. Compare this to credit cards that often exceed 25% interest with hidden charges.

| Feature | LendDirect | Magical Credit |

|---|---|---|

| Funding Speed | 15 minutes | 1 business day |

| APR Range | 22.9%-29.9% | 19.99%-35% |

| Protection Plan | Not Available | Optional coverage |

| Fee Types | 1 processing fee | 3 disclosed fees |

Optional payment protection helps during job loss or illness. This safety net covers up to 6 months of payments, giving breathing room when life surprises you.

Both providers use plain-language contracts. You’ll know exactly how rates apply and when payments are due. No fine print tricks – just fair terms that respect your budget.

Benefits for Customers with Diverse Credit Profiles

Your financial history shouldn’t lock you out of opportunities. Our partners create pathways for borrowers across the credit spectrum, focusing on current stability rather than past challenges.

Financial Solutions Across the Credit Spectrum

Magical Credit takes a fresh approach by evaluating 12+ income types – from freelance work to disability benefits. Their two-step verification starts with a soft credit check that leaves your score untouched. Only approved applications trigger deeper reporting agency reviews.

LendDirect’s system weighs multiple factors:

- Consistent employment history (6+ months preferred)

- Bank account balance trends

- Debt-to-income ratio under 40%

“We’ve helped 63% of applicants improve their credit score through structured repayment plans,” notes a LendDirect representative. This focus on growth turns temporary solutions into long-term financial wins.

| Feature | Magical Credit | LendDirect |

|---|---|---|

| Credit Check Type | Soft → Hard | Custom Blend |

| Income Verification | 12+ Sources | 5 Core Sources |

| Credit Building | Optional Reporting | Automatic Reporting |

| Ideal For | Government Benefit Recipients | Steady Earners Rebuilding Credit |

Both lenders avoid blanket rejections. Recent data shows 78% approval rates for applicants with scores below 600 when other stability markers exist. Whether you need payday loans between checks or larger personal credit lines, options adapt to your situation.

Managing Your Loan Account Seamlessly

Staying in control of your finances is simpler than ever with digital tools. LendDirect’s platform transforms how you handle repayments through user-friendly features accessible from any device.

Online Payments and Mobile App Tracking

The mobile app puts financial control in your pocket. View balances, review payment history, and schedule transfers while commuting or waiting in line. Automatic options sync with your bank account to prevent missed deadlines.

Need flexibility? Make extra payments anytime without fees. These reduce principal balances faster, potentially lowering interest costs. Real-time updates show progress immediately after each transaction.

Digital receipts create organized records for tax season or budget reviews. Forgot a due date? Push notifications remind you 48 hours before withdrawals. Support teams answer questions through in-app chat during extended hours.

| Feature | Benefit |

|---|---|

| Auto-Pay | Never miss a payment |

| Mobile Dashboard | Track progress anywhere |

| Extra Payments | Reduce debt faster |

| 24/7 Access | Update details anytime |

Interac e-Transfer keeps funds moving securely between accounts. Whether handling payday loans or larger credit lines, these tools help maintain financial stability without stress.

Transparent Interest Rates and Repayment Terms

Clarity in borrowing costs builds trust from day one. Magical Credit leads with straightforward pricing models that eliminate guesswork. Their installment options feature annual percentage rates between 19.99% and 35%, tailored to your financial profile and loan amount.

Customized Payment Plans That Work

Repayment flexibility starts with multiple scheduling choices. Choose bi-weekly, semi-monthly, or monthly installments that sync with your income flow. A $1,500 borrowed over 12 months at 2.9% monthly interest demonstrates this approach:

| Payment Frequency | Installment Amount | Total Interest |

|---|---|---|

| Monthly | $168.75 | $525 |

| Bi-Weekly | $77.88 | $525 |

| Semi-Monthly | $84.38 | $525 |

Early payoff saves money through simple interest calculations. Unlike traditional lenders, Magical Credit charges only on your remaining balance. Pay off your $2,025 total in 6 months? You’ll save $262.50 in interest.

“Our open loan structure rewards financial progress – no penalties for paying ahead.”

Longer terms (up to 60 months) help manage larger amounts. This stretches payments while keeping monthly obligations manageable. Payment dates adjust to your paycheck schedule, preventing budget strain.

Responsible Lending and Borrowing Guidelines

Building financial trust starts with clear expectations. Our partner lenders prioritize ethical practices through careful applicant reviews and educational resources. This approach helps borrowers make informed choices while maintaining sustainable credit relationships.

Credit Check Criteria and Approval Process

Magical Credit uses soft checks during initial applications to protect your score. Their three-tier review process evaluates income stability, payment history patterns, and existing obligations. Only approved candidates undergo hard inquiries before finalizing terms.

Key approval factors include:

- Consistent 90-day employment history

- Open bank accounts in good standing

- Debt-to-income ratios below 45%

Guidelines to Prevent Overextension

Responsible lending means saying “no” when necessary. Our network declines applications requiring payments exceeding 35% of monthly income. Borrowers receive personalized loan amount recommendations based on their budget analysis tools.

We encourage setting up automatic payments through secure portals. This reduces missed deadlines while building positive credit history. Free financial coaching helps adjust repayment plans if life circumstances change unexpectedly.