Equity Loan Options: Compare Rates & Get Approved

Your property’s value isn’t just a number—it’s a powerful financial tool. Many homeowners are discovering how to use their built-up home equity to fund renovations, consolidate debt, or cover major expenses. With fixed terms and predictable payments, these solutions often provide better rates than credit cards or personal loans.

This guide simplifies your choices, from traditional lump-sum agreements to flexible credit lines. Major lenders like U.S. Bank and Navy Federal stand out with perks like no closing costs or application fees. You’ll also learn how intro offers and repayment timelines vary between institutions.

Key Takeaways

- Tap into your property’s value for large expenses or debt consolidation

- Compare fixed-rate agreements versus adjustable credit lines

- Top lenders offer fee-free applications and fast approvals

- Current market conditions favor competitive terms

- Understand qualification criteria before applying

We’ll break down current offers from trusted providers, including Bank of America’s high loan-to-value ratios. You’ll gain practical tools to estimate payments and navigate approval steps confidently. Let’s explore how to make your house work smarter for your financial goals.

Understanding Home Equity and Loan Basics

Your living space isn’t just shelter—it’s a dynamic asset in your financial portfolio. Let’s explore how this works through two key concepts every homeowner should know.

Home Equity Defined

Home equity measures your actual ownership stake. Imagine your house sells for $300,000 today, and you owe $180,000 on your mortgage. Your equity equals $120,000. This number grows as you pay down your mortgage or when local housing prices rise.

There are two paths to building wealth in your property. Each monthly payment chips away at your loan balance. Meanwhile, market shifts might boost your property’s value without any effort on your part. Over time, these factors combine to create financial flexibility.

Equity Loan Overview

Lenders often let you borrow against up to 80% of your available equity. This collateral-backed approach typically offers better rates than unsecured options. Whether you’re renovating kitchens or covering college tuition, these funds turn your investment into actionable cash.

Remember: Your borrowing power depends on current appraisals and remaining mortgage balances. Tools like online estimators help gauge potential amounts quickly. With this foundation, you’re ready to compare lending products confidently.

What is an Equity Loan?

Unlocking your home’s financial potential starts with understanding your borrowing choices. A home equity loan delivers a single lump sum upfront, using your property’s value as security. Often called HELOANs, these agreements feature fixed interest rates and scheduled repayments over 15-30 years.

Fixed Rate Benefits vs. Variable Options

Stability defines fixed-rate agreements. Your monthly payment stays identical throughout the term, shielding you from market fluctuations. This predictability makes them ideal for long-term projects like kitchen remodels or college tuition.

Variable-rate products like HELOCs work differently. They offer revolving credit lines with adjustable rates that mirror financial indexes. While initial rates often look appealing, they can climb significantly over time.

Consider these factors when choosing:

- Budget certainty: Fixed plans simplify financial forecasting

- Flexibility needs: Credit lines allow repeated borrowing

- Rate trends: Rising markets favor fixed options

Most lenders let you borrow up to 85% of your available equity. Use online calculators to compare 10-year versus 30-year terms. Remember: Your home secures both loan types, so timely payments protect your investment.

Comparing Home Equity Loan and HELOC Options

Choosing between different financial tools can feel overwhelming until you understand their core functions. Let’s break down how two popular solutions handle funds and payments differently.

Repayment Structures and Terms

Lump-sum agreements work like traditional mortgages. You receive all funds upfront and make fixed monthly payments covering principal and interest. This structure suits single expenses like roof replacements, where costs are predictable.

Credit lines operate differently. During the 10-year draw period, you pay interest only on what you use. Need $15,000 for medical bills now and $10,000 later? Tap your available line as needed. After the draw phase, a 20-year repayment period begins.

Rate Comparison and Flexibility

Fixed-rate options lock in your rate, protecting against market hikes. Variable-rate HELOCs often start lower but adjust quarterly. Some lenders let you convert portions to fixed rates—Bank of America allows this on balances over $5,000.

Consider your timeline and risk tolerance. Renovating a bathroom? A fixed plan offers stability. Managing fluctuating expenses? A credit line provides adaptable access without reapplying.

Key Features and Benefits of Home Equity Loans

Smart financial moves often start with minimizing upfront expenses. Leading lenders now remove traditional barriers by covering common charges that once added thousands to borrowing costs.

Cutting Through the Fee Fog

U.S. Bank sets the standard with zero closing costs on their home equity products. Navy Federal goes further—covering all settlement fees while waiving application and origination charges. This could save homeowners $300-$2,000 compared to standard agreements.

Bank of America’s flexible credit lines up to $1 million come with no annual fees. Unlike credit cards that charge yearly maintenance, these plans keep ongoing expenses predictable. You’ll only pay interest on what you use.

Traditional lenders often add:

- 3-6% origination fees

- Appraisal charges ($300-$600)

- Title search costs ($200-$400)

These savings prove especially valuable for debt consolidation. More of your funds go toward balancing high-interest accounts instead of covering administrative expenses. Always verify if your lender requires property inspections—some handle these costs internally.

How to Qualify for Your Home Equity Loan

Securing funds through your property requires meeting specific lender benchmarks. Let’s explore the essential criteria that determine approval success and borrowing capacity.

Credit Score and Equity Requirements

Most financial institutions prioritize two factors: your financial reliability and property value. A FICO score of 660 serves as the baseline, but scores above 730 unlock premium rates. U.S. Bank and Navy Federal typically allow borrowing up to 80% of your available property value cushion.

| Lender | Minimum Credit Score | Max Equity Borrowed |

|---|---|---|

| U.S. Bank | 660 | 80% |

| Navy Federal | Varies by CLTV | 85% |

| Traditional Lenders | 680+ | 75% |

Application Criteria and Documentation

Lenders evaluate your entire financial picture through three lenses:

- Consistent income history (2+ years preferred)

- Debt payments below 43% of gross income

- Property valuation matching loan requests

“We look for stability in employment and responsible credit use over time,” notes a Navy Federal underwriter.

Prepare these documents for smoother processing:

- Recent pay stubs (last 30 days)

- Two years of tax returns

- Current mortgage statements

Boost approval odds by reducing credit card balances and verifying property details beforehand. Minor kitchen upgrades could increase your home’s appraised value, expanding borrowing potential.

Estimating Monthly Payments and Managing Costs

Planning your finances starts with clear payment expectations. Online calculators transform complex math into actionable insights. Simply input three numbers: desired amount, current rate, and repayment timeline. Instantly see how these choices affect your budget.

Using Payment Calculators for Projections

Let’s break down Navy Federal’s example. A $100,000 agreement at 7.65% over 20 years equals $814.79 monthly. That’s $95,549 interest over time—almost matching the original amount. Shorter terms change the game: a 15-year plan at the same rate jumps payments to $936.43, but slashes total interest by $32,000.

U.S. Bank’s digital tools let you test scenarios instantly. Longer timelines lower monthly costs but increase overall expenses. Always add 10-15% to calculator results for potential tax or insurance costs. As one financial advisor notes: “Tools show the floor, not the ceiling of your obligations.”

Smart borrowers compare multiple term lengths. Could $50,000 cover your needs instead? Would a 5-year difference make your budget breathe easier? Experiment freely—these calculators don’t affect your credit score.

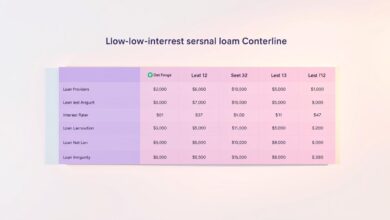

Rates, Fees, and Terms Explained

Smart borrowers look beyond the advertised numbers to understand true borrowing costs. Let’s unpack how lenders calculate your expenses and what makes rates shift between offers.

Interest Rate vs APR: Know the Difference

Your interest rate shows the basic cost of borrowing money. APR (Annual Percentage Rate) includes fees like origination charges and closing costs. For example, U.S. Bank’s 8.74% APR might combine a 7.9% rate with $1,200 in fees.

Credit scores dramatically affect your rate. Navy Federal rewards 750+ FICO scores with 7.34% APR on 5-year terms. Lower scores might see rates climb to 9.15% APR. Lenders also consider:

| Lender | Rate Type | Current Rate | Discounts |

|---|---|---|---|

| U.S. Bank | Fixed | 8.74% APR | 0.50% autopay |

| Navy Federal | Fixed | 7.34% APR | Direct deposit bonus |

| Bank of America | Variable | WSJ Prime +1% | 0.25% autopay |

Fixed-rate options lock in today’s rates for payment certainty. Variable plans like Bank of America’s HELOC start lower but follow market trends. “Always ask if rate caps limit how high your payments can climb,” advises a mortgage planner from NerdWallet.

Look for relationship discounts—existing customers often get 0.25%-0.50% rate reductions. Automatic payments frequently unlock extra savings. Compare total 5-year costs across lenders, not just monthly payments, to spot hidden fees.

Navigating the Fast and Simple Application Process

Modern lenders have transformed borrowing into a streamlined digital experience. With secure online platforms, you can now explore options and submit paperwork without leaving your couch.

Get Answers Before You Commit

U.S. Bank’s prequalification tool shows potential amounts in minutes—no credit score impact. Simply enter your property details and desired funds. Bank of America takes this further: their 15-minute digital form auto-fills repeat information, saving you time.

Paperwork Made Painless

Gather these essentials before starting:

- Recent pay stubs (last 30 days)

- Two years of tax returns

- Current mortgage statements

Most institutions like Navy Federal use military-grade encryption for document uploads. Once submitted, their team typically responds within 2 business days. While approvals can take 30-40 days, early preparation cuts waiting time significantly.

Pro tip: Set calendar reminders for lender follow-ups. Quick responses keep your application moving smoothly toward funding day.