Fast Approval Emergency Loans for Unexpected Expenses

Life doesn’t always follow a plan. When surprise costs pop up—like medical bills or car repairs—it helps to know where to turn. This guide walks you through quick financial solutions designed to ease stress during urgent situations. Whether you’re an individual, family, or small business, there are options to help you regain stability.

Traditional lenders often take weeks to approve applications. But fast-approval options prioritize speed and flexibility. Many providers focus on your ability to repay rather than strict credit scores. This makes them accessible even if your financial history isn’t perfect.

Understanding your choices is key. Federal disaster relief programs might cover specific crises, while private lenders offer short-term personal loans. Each option has unique terms, so comparing rates and requirements ensures you pick the best fit.

We’ll break down how to apply, what documents you need, and how to spot trustworthy providers. You’ll also learn about repayment plans that align with your budget. With the right information, securing assistance becomes straightforward and stress-free.

Key Takeaways

- Fast-approval options prioritize speed over traditional lengthy processes.

- Flexible qualifications make these solutions accessible to more people.

- Compare federal programs and private lenders to find the best terms.

- Gather necessary documents beforehand to streamline applications.

- Understand interest rates and repayment plans to avoid future strain.

Understanding Emergency Loans and Their Benefits

When life throws curveballs—like a flooded basement or sudden job loss—having access to urgent financial help matters. Specialized funding options exist to address these critical moments. Let’s explore what situations qualify and how this support can stabilize households and businesses.

What Qualifies for Urgent Financial Assistance

Not every unexpected cost meets the criteria. Approved scenarios often involve natural events like hurricanes, wildfires, or government-declared crises. For example, if a tornado damages your roof, you might qualify for funds to repair it. These programs also cover income gaps when disasters disrupt work.

“Recovery financing isn’t just about repairs—it’s about keeping families fed and businesses running during tough times.”

Top Perks of Crisis-Focused Funding

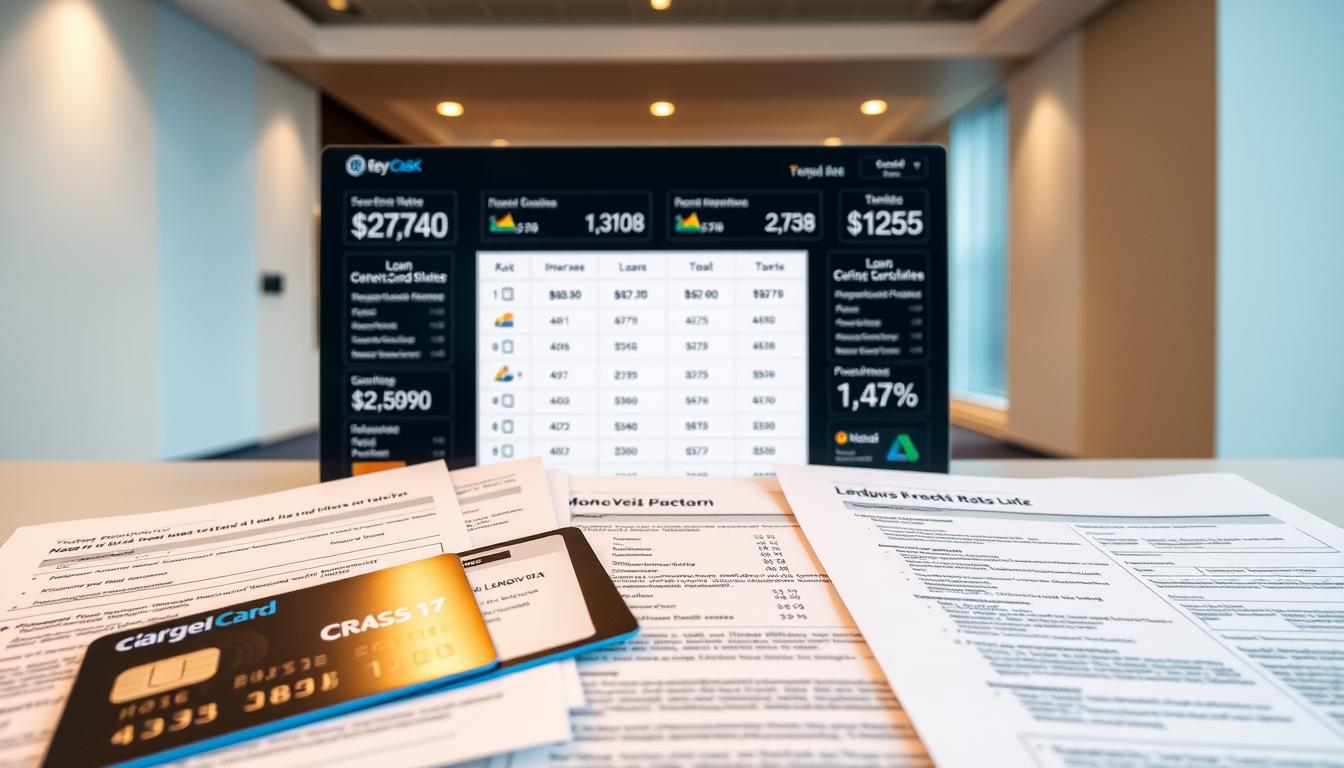

This type of support offers unique advantages compared to standard options. Lower interest rates reduce long-term costs, while flexible terms consider your current challenges. Here’s how it helps:

| Need | Traditional Options | Disaster Recovery Financing |

|---|---|---|

| Approval Speed | 2-4 weeks | As fast as 48 hours |

| Rate Range | 7-36% APR | 3-8% APR |

| Usage Flexibility | Restricted | Home repairs, business costs, daily expenses |

Farmers can reorganize operations, while renters might replace flood-damaged furniture. Businesses often use these funds to cover payroll during rebuilding phases. The goal? Help you recover without creating new financial headaches.

Quick tip: Always check if your area has federal disaster declarations. This unlocks additional programs with enhanced benefits for replacing essentials or covering temporary housing.

The Process Behind Fast Approval Emergency Loans

Navigating financial hurdles requires clear steps and preparation. Let’s break down how these specialized programs work, from initial paperwork to final approval.

Application Requirements and Documentation

Start by gathering proof of disaster-related losses. This includes repair estimates, income statements, and tax records. Applicants must also create a detailed plan showing how funds will rebuild operations or cover critical expenses.

For example, farmers might outline crop replacement costs. Business owners could list equipment repairs. This clarity helps lenders understand your needs quickly.

Eligibility Criteria and Declination Letters

To qualify, you must prove active involvement in farming or business when the disaster struck. A key requirement? Showing you’ve sought traditional financing first.

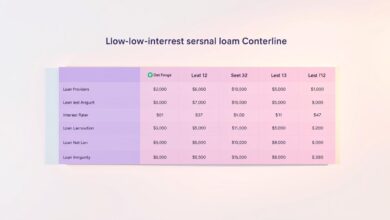

| Loan Amount | Declination Letters Needed |

|---|---|

| $100,000 – $300,000 | 1 letter |

| Over $300,000 | 2 letters |

These letters from banks confirm you’ve explored other options. It streamlines the approval process for urgent needs.

Understanding Repayment Terms and Interest Rates

Rates adjust monthly but lock at the lower value between application approval and closing. This protects borrowers if rates rise during processing.

- Maximum amount: $500,000 (based on documented losses)

- Repayment: Tailored to asset lifespan and cash flow

- Timeline: 12-18 months for operating costs

As one financial advisor notes: “These programs prioritize recovery over profit, giving borrowers breathing room.” Annual payments keep budgets manageable while rebuilding.

Discovering Lenders and Resources in the United States

Finding the right financial support starts with knowing where to look. Federal and state programs offer tailored solutions for rebuilding after crises. Let’s explore how to connect with these resources efficiently.

Federal and State Resources (FSA and SBA Programs)

The Farm Service Agency (FSA) provides recovery funding for agriculture professionals. When natural disasters strike, farmers and ranchers in primary disaster areas—or neighboring counties—can apply for help. These funds cover crop losses, equipment repairs, or production costs.

The Small Business Administration (SBA) extends similar support to businesses and homeowners. Their disaster assistance programs help replace damaged property or maintain operations during recovery. Both agencies require federal disaster declarations in your area.

| Program | Focus | Eligibility | Loan Use |

|---|---|---|---|

| FSA | Agriculture recovery | Farmers in declared areas | Crops, livestock, equipment |

| SBA | Business continuity | Businesses & homeowners | Property repairs, working capital |

How to Find and Compare Lenders

Start by visiting official .gov websites like Farmers.gov or the SBA’s disaster portal. These platforms provide updated program details and application checklists. Local FSA offices can clarify eligibility rules or suggest alternative options.

- Verify lender credentials through .gov domain URLs

- Compare interest rates and repayment timelines

- Ask about deferred payment options during rebuilding

“Always cross-check information across multiple .gov sources—it ensures you’re getting the latest program updates.”

For personalized guidance, schedule appointments with FSA specialists. They’ll help match your needs with the right assistance, whether you’re restoring farmland or a family business.

Conclusion

Rebuilding after unexpected events requires smart financial strategies. Federal programs like FSA and SBA assistance provide structured support with lower interest rates and adaptable repayment plans. These options help families address property damage or keep businesses running during recovery phases.

Preparation makes a difference. Understanding eligibility rules and gathering tax records or repair estimates upfront can slash approval times. Most applications need submission within eight months of official disaster declarations—acting quickly maximizes your options.

Connect with local FSA offices before crises strike. Building these relationships ensures faster access to funds when urgent needs arise. Whether covering temporary housing costs or equipment repairs, these solutions prioritize practical recovery over perfect credit histories.

Required declination letters from banks shouldn’t discourage you. They simply confirm existing options don’t meet your needs. Bookmark trusted .gov websites for real-time updates on available programs in your area.

From medical bills to storm-related expenses, having the right information transforms overwhelming challenges into manageable steps. Start planning today—your future self will thank you.