Fast Cash Loans: Quick Financial Solutions

Life doesn’t always follow a plan. When unexpected expenses pop up, having access to quick financial support can make all the difference. Many lenders now offer streamlined solutions that let you apply online or visit a physical location, giving you options based on your comfort level.

With over 25 years of experience, trusted providers have helped more than 1.1 million people handle urgent needs. Whether it’s a car repair, medical bill, or a temporary budget gap, these services focus on speed and simplicity. Approval decisions often come quickly, and funds can arrive in your account in as little as 30 minutes after approval.

Modern solutions blend digital convenience with in-person service. Over 10,000 customers each month rely on this flexibility to address pressing challenges. With 19+ locations available, you can choose the method that works best for your situation—no lengthy paperwork or delays.

Key Takeaways

- Immediate access to funds helps address emergencies without traditional banking delays

- Providers with 25+ years of experience prioritize secure, reliable transactions

- Applications can be completed online or at physical stores for maximum flexibility

- Approved requests often receive funds within 30 minutes via e-transfer

- Services cater to over 10,000 customers monthly, reflecting widespread trust

Introduction to Fast Cash Loans

When bills pile up before payday, options matter. Short-term lending solutions help bridge gaps between unexpected costs and your next paycheck. These services focus on speed and flexibility, offering alternatives to traditional payday loans with simpler processes.

Traditional banks often require weeks for approvals and stacks of paperwork. Modern lenders prioritize your current needs over strict credit history checks. This approach helps people across different financial situations access support quickly, even if they’ve faced past credit challenges.

Reputable providers design their services around real-life circumstances. Whether you’re dealing with medical bills or car repairs, solutions exist that fit your timeline. Many applicants appreciate the transparent terms and personalized repayment plans that adapt to their budgets.

These lending options also create opportunities to rebuild financial trust. Timely repayments can demonstrate responsibility, potentially improving future borrowing prospects. Providers often pair funds with guidance to help customers make informed decisions.

With over 10,000 monthly users, these services have become a go-to resource for urgent needs. Digital applications and in-person locations ensure everyone finds a comfortable path forward—no perfect credit score required.

How Fast Cash Loans Work

Navigating financial hurdles requires efficient methods tailored to modern needs. Providers offer two streamlined paths to access support: digital convenience or personalized guidance. This flexibility ensures you can address urgent situations through your preferred approach.

Online vs In-Store Application

The digital path lets you start the process anytime using your smartphone or computer. Complete simple forms at 2 AM or during lunch breaks—no need to adjust your schedule. Secure portals protect your personal information while automated checks accelerate approvals.

Prefer face-to-face help? Visit one of 19 physical locations where specialists walk you through each step. They’ll explain requirements clearly and answer questions about repayment plans. This option works well for those valuing human interaction during financial decisions.

Fast Funding with Interac e-Transfer

Once approved, modern systems deliver funds directly to your bank account in minutes. Automated transfers work day and night, even when stores close. Most users see money arrive within 30 minutes of signing agreements.

This technology eliminates waiting for checks or wire transfers. You’ll receive email notifications the moment funds move, letting you address needs immediately. Whether replacing a broken appliance or covering medical costs, timely support helps regain control.

Benefits of Choosing Fast Cash Loans

Financial surprises can knock when you least expect them. Modern lending solutions offer clear advantages for urgent situations, combining efficiency with thoughtful design. These services prioritize your immediate needs while maintaining strong safeguards for your security.

Quick Approval & Easy Application

Gone are the days of waiting weeks for answers. Advanced systems analyze applications in real time, focusing on your current financial picture rather than past credit hiccups. Many applicants receive decisions before they finish their coffee.

The digital process requires just basic details—no stacks of paperwork. You can complete everything from your phone while waiting in line or during a lunch break. Secure portals protect your information better than traditional mail-in forms ever could.

Since emergencies don’t punch a clock, applications stay open 24/7. Night owls and early birds alike appreciate accessing support when they need it most. Best of all, you won’t risk losing personal assets since these are unsecured agreements.

Trusted providers use military-grade encryption to guard your data. This careful balance of speed and security helps thousands handle unexpected car repairs or medical bills monthly. It’s financial flexibility designed for real life.

Easy Application and Quick Approval Process

Managing urgent expenses requires solutions that adapt to your schedule. Modern lending services combine intuitive technology with human expertise, creating a seamless path from start to approval. Whether you’re night owl or early riser, support flows through multiple channels to match your preferences.

Step-by-Step Application Guide

The digital process walks you through each stage with simple prompts. Here’s how it works:

- Complete basic personal and financial details in secure online fields

- Review automated suggestions for missing information

- Submit documents electronically using your phone’s camera

Most applicants finish in under 10 minutes. Real-time error checks prevent delays by highlighting incomplete sections before submission.

Personalized Customer Support

Knowledgeable staff bring warmth to financial decisions. Reach them weekdays 5AM-8PM PST or weekends 9AM-5PM through:

| Support Type | Availability | Response Time |

|---|---|---|

| Phone Calls | All open hours | <2 minutes |

| Secure Messages | 24/7 | Under 1 hour |

| In-Person Help | Select locations | Immediate |

Representatives explain complex terms using everyday language. “We treat every application as unique,” notes a team lead with 12 years’ experience. “Our goal is making you comfortable with each decision.”

Automated systems handle contracts after hours while maintaining security standards. This hybrid approach ensures you control timing without sacrificing human connection when needed.

Funding: Receiving Cash Within Minutes

Time matters most during financial emergencies. Modern solutions ensure you don’t wait hours—or days—to access support. Once approved, your funds move through secure channels designed for immediate relief.

Instant Deposit Steps

The process starts when you accept your agreement digitally. Automated systems spring into action around the clock, sending money through Interac e-Transfer. Most transfers reach your bank account in under five minutes.

Here’s what happens next:

- Automatic deposits appear instantly if your bank supports this feature

- Manual transfers require clicking a secure link in your email

- 24/7 availability means weekend approvals work exactly like weekday requests

Need up to $10,000? Larger amounts follow the same speedy path. Account verification checks protect against errors while keeping your details safe. This approach beats traditional methods that often take three business days.

Real-time notifications keep you informed every step. You’ll know exactly when your money arrives—no guessing or refreshing your balance. It’s financial support designed for right now, not tomorrow.

Transparent Terms and Trusted Lending Practices

Financial agreements should never feel like a mystery. Reputable providers prioritize clarity, ensuring you understand every aspect of your credit arrangement before committing. This approach builds trust and helps borrowers make decisions aligned with their financial goals.

Clear Fee Structures & Rates

Providers explain all costs upfront, including exact dollar amounts for fees and interest rates. You’ll see the total repayment amount before signing, letting you budget confidently. Annual percentage rates (APR) appear in plain language—no confusing fine print.

Repayment schedules sync with your paycheck dates. “We design payment plans around your income cycle,” explains a lending specialist. This prevents due dates from clashing with tight budget periods.

Your current financial capacity matters more than past credit challenges. This focus helps people rebuild their financial standing through responsible borrowing. Over 8,000 Trustpilot reviews highlight satisfaction with these fair practices.

Every loan detail arrives in writing for review. You get time to ask questions and confirm understanding. This transparency extends beyond legal requirements—it’s about empowering your financial future.

Understanding Lending Regulations and Fees

Every state sets its own playbook for short-term lending practices. Knowing these rules helps you make smarter choices while avoiding surprises. Whether you’re considering a payday loan or other options, understanding costs and protections puts you in control.

Local Lending Regulations in the United States

Your location shapes what lenders can offer. Some states cap loan amounts at 25% of your monthly income, while others allow higher limits. Reputable providers display state licenses prominently—like #50066 in California or #21-23-CA291-1 in Texas—proving they follow local laws.

Most areas limit fees to $15 per $100 borrowed. These caps prevent excessive charges while letting lenders operate responsibly. Always verify a company’s license status through your state’s financial regulator website before applying.

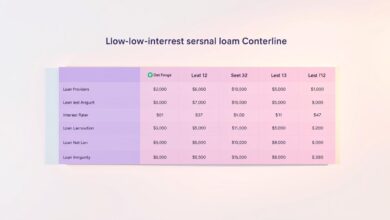

APR, Repayment Terms, and Additional Fees

Annual Percentage Rates (APR) show borrowing costs clearly, even reaching 390% for 14-day agreements. While this sounds high, it helps compare different payday loans fairly. A $400 loan might cost $60 in fees—knowing this upfront helps budget repayments.

States require clear disclosure of late fees or rollover charges before signing. Responsible lenders explain these details in plain language. Some skip traditional credit checks, focusing instead on income verification through recent pay stubs or bank statements.

Remember: You have rights to cancel agreements within 24 hours in many states. Keep copies of all documents and ask questions until every term makes sense. Smart borrowing starts with understanding the rules.

Getting Started: Requirements & Application Tips

Taking the first step toward financial relief starts with knowing what’s needed. Clear guidelines help you prepare efficiently, whether you’re new to borrowing or have used similar services before. Let’s break down the essentials to simplify your journey.

Eligibility and Essential Documentation

You’ll need basic items to verify your identity and income. Most providers require a government-issued ID, recent pay stubs, and an active bank account. These documents help confirm your ability to manage repayments smoothly.

Some lenders ask for proof of residency, like utility bills. Having these ready speeds up the process. Eligibility requirements often focus on steady income rather than perfect credit history.

Practical Tips for a Smooth Process

Double-check every field before submitting your application. A single typo can delay approval. Keep digital copies of your paperwork handy—snap photos with your phone if you’re applying online.

Reach out to customer support if any step feels unclear. Many teams offer real-time chat or quick callback options. With preparation and attention to detail, you’ll navigate the process confidently and get back to handling life’s surprises.