Find easy loans near me with fast approval rates

When unexpected expenses hit, getting quick access to funds can feel like a race against time. Local financial solutions are often the fastest way to secure cash without the wait times of traditional banks. Many lenders in your community specialize in same-day approvals, turning stressful situations into manageable ones.

Neighborhood providers understand urgent needs better than online-only services. They frequently offer personalized guidance to help you choose between payday advances or installment plans. This hands-on approach ensures you get the right fit for your budget and timeline.

Modern applications take minutes to complete, with many approvals happening within hours. Transparent terms and clear communication let you borrow confidently, knowing exactly when funds will arrive. Always compare rates and repayment schedules to find the best deal for your situation.

Key Takeaways

- Local options often provide faster approvals than national institutions

- Personalized service helps match financial products to your needs

- Many lenders deposit funds within one business day

- Compare multiple offers to secure favorable terms

- Clear repayment plans prevent future financial stress

Understanding Loan Options and Fast Approval Processes

When cash shortages strike, digital tools offer a lifeline without the hassle. Modern platforms let you explore financial solutions tailored to your situation, even if traditional banks have turned you down. Income-based approvals now take priority over strict credit history reviews for many lenders.

Benefits of Online Loan Applications

Digital applications cut through the red tape. You can complete forms in minutes and receive decisions within hours—no need to rearrange your schedule for in-person meetings. Many services operate 24/7, letting you apply during lunch breaks or late-night emergencies.

What makes online options stand out? Transparency. Lenders clearly outline repayment terms and fees upfront. This helps you avoid surprises while comparing multiple offers side-by-side.

Types of Loans: Payday, Personal, and Secured Options

Payday advances work best for small, urgent needs. Providers like Speedy Cash focus on your current income rather than past credit missteps. These short-term solutions typically require repayment by your next paycheck.

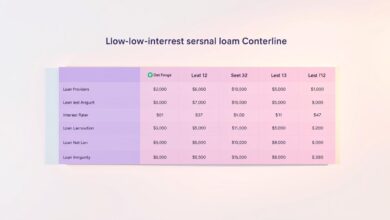

Personal loans offer larger amounts for debt consolidation or major purchases. Secured options need collateral but often have lower rates. Each choice serves different needs—understanding the details ensures you pick wisely.

Loans near me: Your Local Lending Directory

Local financial services bring face-to-face support to your neighborhood. Companies like Speedy Cash operate 20 physical stores across Canada, serving communities from British Columbia to Nova Scotia. These brick-and-mortar locations combine digital convenience with in-person expertise.

Connecting With Community Financial Experts

Neighborhood lenders prioritize relationships over transactions. Staff at store locations explain repayment plans using simple examples—like budgeting for car repairs or medical bills. You’ll get paper copies of all agreements and instant answers to urgent questions.

Multiple access points mean you can visit a place along your commute or near your workplace. Many providers maintain stores in shopping centers for easy parking and weekend hours. Always verify specific services through their website or quick phone call first.

Some companies complete applications and fund disbursements during single visits. This eliminates waiting for bank transfers while maintaining clear communication. Local teams also help adjust payment schedules if unexpected challenges arise later.

Instant and Payday Loans Online: Speed and Convenience

Financial emergencies don’t wait for payday. Digital platforms now deliver urgent cash solutions faster than ever, with many providers processing requests in under an hour. Same-day decisions eliminate the anxiety of waiting weeks for traditional approvals.

Eligibility Without Traditional Credit Checks

Modern lenders prioritize your ability to repay over past credit scores. Proof of steady income—like recent bank statements or pay stubs—often replaces lengthy background checks. This approach helps borrowers with less-than-perfect histories access funds during crises.

Fast Fund Transfers and Application Timelines

Approved applications typically receive money within hours. Most providers use Electronic Money Transfer (EMT) or direct deposit to speed up delivery. Here’s what to expect:

- Applications take 8-15 minutes to complete

- Approval notifications arrive via text or email

- Funds clear by 5 PM often land same business day

Timing matters when choosing providers. Some process requests 24/7, while others follow banking hours. Always confirm transfer details before submitting your request to avoid delays.

Evaluating

Smart financial decisions start with careful evaluation of available options. Compare approval timelines, repayment structures, and lender reputations to find solutions that align with your budget. Transparent providers clearly outline fees and conditions upfront—prioritize those who explain terms in plain language.

Digital tools simplify side-by-side comparisons without leaving home. Many platforms let you filter offers by amount, timeline, or eligibility requirements in seconds. Local branches add value through in-person consultations for complex situations, blending tech efficiency with human insight.

Always verify lender credentials through official databases like the Better Business Bureau. Check customer reviews for real-world experiences with fund disbursement speeds and service quality. This dual approach helps avoid unreliable providers while identifying trustworthy partners.

Taking time to assess your choices pays dividends long after initial approval. Whether opting for online convenience or neighborhood expertise, informed decisions create sustainable paths through financial challenges.