Find the Best Low Interest Personal Loans Online

Need extra funds for a big purchase or debt consolidation? A personal loan could be your solution. These financial tools let you borrow a fixed amount of money, repaid through predictable monthly installments. With APRs ranging from 6.49% to 35.99% (based on LendingTree data), choosing wisely could save you thousands over time.

Top lenders like Upgrade, LightStream, and Discover offer competitive rates starting below 8% APR for qualified borrowers. Your credit score, income stability, and existing debts play major roles in determining your eligibility. Even small differences in percentage points can dramatically impact your total repayment amount.

This guide will help you compare options efficiently. We’ll show how to evaluate lenders, leverage online comparison tools, and negotiate better terms. Whether you need funds for home improvements or unexpected expenses, understanding today’s lending landscape puts you in control.

Key Takeaways

- APR ranges vary widely (6%–35.99%) based on creditworthiness and lender policies

- Top US lenders include LightStream (from 6.49% APR) and Discover (up to 24.99% APR)

- Fixed monthly payments simplify budgeting compared to variable-rate products

- Strong credit profiles unlock the most favorable rates and terms

- Online comparison platforms help identify cost-effective solutions quickly

Understanding low interest personal loans

Managing large costs effectively starts with choosing the right financial tool. Let’s explore how structured borrowing options work and what makes them valuable for planned or unexpected needs.

What Is a Personal Loan?

A personal loan provides immediate access to funds through a single disbursement. Unlike credit cards that offer revolving limits, you receive a fixed lump sum upfront. This makes it ideal for projects requiring full payment upfront, like kitchen remodels or medical bills.

Most lenders offer amounts between $500 and $200,000, with repayment schedules spanning six months to seven years. Since these are typically unsecured, you won’t risk assets like your car or home. However, this convenience often means slightly higher rates compared to secured alternatives.

How Competitive Rates Are Earned

Lenders reserve their best offers for borrowers demonstrating financial stability. A credit score above 670, consistent income, and a debt-to-income ratio below 36% significantly improve approval odds. Shorter repayment periods (12–36 months) usually feature lower rates but require higher monthly payments.

As one financial advisor notes:

“Borrowers should treat loan applications like job interviews – showcase reliability through documentation and smart financial habits.”

Online platforms simplify comparisons by letting you preview potential loan terms without hard credit checks. Always review origination fees and prepayment penalties before committing to ensure full cost transparency.

Product Roundup: Key Features of Top Personal Loans

Smart borrowers compare multiple options before committing. Let’s explore how leading providers differ in funding ranges, repayment timelines, and upfront costs.

Loan Amounts and Terms

Funding needs vary widely – from emergency car repairs to major home upgrades. LightStream and SoFi lead with up to $100,000, while PenFed accommodates smaller requests starting at $600. Most lenders set repayment windows between 2-7 years.

| Lender | Amount Range | Terms Available | Origination Fee |

|---|---|---|---|

| LightStream | $5k–$100k | 24–84 months | 0% |

| Upstart | $1k–$50k | 36–60 months | 0-12% |

| PenFed | $600–$50k | 12–60 months | 0% |

Repayment Flexibility and Origination Fees

Some providers charge origination fees – upfront costs deducted from your loan amount. Discover and LightStream skip these fees entirely, while Upstart may deduct up to 12%. Always calculate the actual amount received after fees.

Look for lenders offering payment date adjustments or penalty-free early payoffs. As one banking expert advises:

“Treat origination fees like sales tax – factor them into your total budget before signing.”

Evaluating Interest Rates and APRs

Understanding how borrowing costs work helps you save money and avoid surprises. Let’s break down the numbers so you can make confident decisions.

Fixed vs. Variable Rate Options

Fixed rates lock in your costs for the entire repayment period. You’ll pay the same amount monthly, making budgeting straightforward. This stability comes at a slight premium – typically 1-2% higher than initial variable offers.

Variable rates change with financial market trends. They might start lower but could increase if the Bank of Canada adjusts its target rate. A recent study shows 68% of borrowers prefer fixed options for long-term loans over three years.

| Credit Score Range | Average APR | Monthly Payment* |

|---|---|---|

| 800-850 | 12.50% | $224 |

| 740-799 | 15.74% | $238 |

| 670-739 | 28.72% | $298 |

| 580-669 | 92.45% | $482 |

*Based on $10,000 loan over 5 years

Your financial profile directly impacts your rates. Lenders weigh credit history, income stability, and existing debts. As one mortgage broker advises:

“Always check the APR disclosure – it reveals the true cost including fees that basic rates don’t show.”

Improving your credit score by 50 points could slash your interest costs significantly. Consider rate-lock guarantees when comparing lenders, and remember – even 0.5% difference saves $387 on a five-year $15,000 loan.

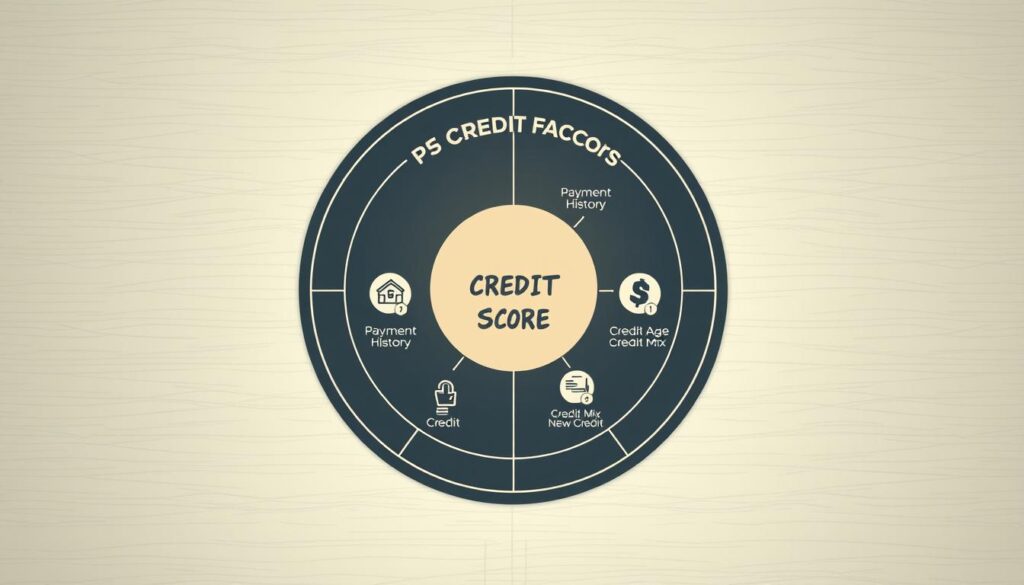

Credit Score, Income, and Eligibility Requirements

Lenders use specific criteria to assess your borrowing reliability. Knowing these requirements helps you prepare stronger applications and secure favorable terms.

Minimum Credit Score and Employment Verification

Your credit score acts like a financial report card. Most lenders set minimum thresholds:

| Lender | Minimum Score | Income Requirement | Max DTI |

|---|---|---|---|

| Upstart | 300 | $12k+ annually | 50% |

| Discover | 660 | $40k+ | 45% |

| SoFi | 680 | Not disclosed | 50% |

Employment verification methods vary. Some providers require pay stubs or tax returns. Others accept bank statements for self-employed applicants. As one underwriter explains:

“Consistent income matters more than job title – we look for reliable cash flow to cover payments.”

Debt-to-Income Ratio and Collateral Considerations

Your debt-to-income ratio (DTI) shows how much income goes toward existing obligations. Most lenders prefer DTIs below 50%. For example, with a $5,000 monthly income, keep total debt payments under $2,500.

Improving eligibility often involves simple steps:

- Pay down credit card balances

- Delay applications after salary increases

- Add co-signers with strong credit histories

While most options don’t require collateral, offering assets could help secure better rates if you have limited credit history.

Secured vs. Unsecured Personal Loan Options

Understanding collateral requirements helps borrowers match financial products to their unique situations. Let’s explore how asset-backed and signature-based options differ in accessibility and risk.

Benefits of Secured Loans

Secured loans use valuable assets like vehicles or home improvements as collateral. This security allows lenders to offer lower rates and higher approval odds. Best Egg, for example, accepts kitchen cabinets or lighting fixtures as collateral for home-related projects.

Key advantages include:

- Rates 3-8% lower than unsecured options

- Borrowing limits up to $100,000

- Easier approval with fair credit scores

| Feature | Secured | Unsecured |

|---|---|---|

| Collateral Required | Yes | No |

| Typical APR Range | 5-15% | 10-36% |

| Max Loan Amount | $100k+ | $50k |

One financial planner notes:

“Collateral acts like a safety net for lenders – it lets them take calculated risks on borrowers who might otherwise get declined.”

While secured options provide better terms, remember lenders can claim your assets if payments stop. Always assess repayment capacity before pledging property. Unsecured loans work better for smaller, short-term needs when protecting assets is a priority.

Lender Comparison: Top US Personal Loan Providers

Finding a reliable lender is crucial for securing favorable terms. The US market offers diverse options through traditional banks and digital-first platforms. Let’s explore key players shaping today’s borrowing landscape.

Major Banks and Financial Institutions

Established banks like Discover provide stability with APRs from 7.99% to 24.99% on amounts up to $40k. PenFed Credit Union stands out with accessible $600 minimums and rates under 18% APR. These institutions often offer branch support for applicants preferring in-person service.

Online Platforms and Private Lenders

Digital innovators like LightStream deliver competitive rates starting at 6.49% APR for loans reaching $100k. Upstart uses AI to evaluate applicants, while SoFi caters to high-earners with flexible $100k limits. Platforms typically process funds faster – often within one business day.

When comparing options, prioritize lenders matching your credit profile and repayment capacity. As one fintech CEO notes:

“Modern borrowers want speed without sacrificing transparency – that’s where tech-driven solutions excel.”