Get Personal Loans with Bad Credit History

Need funds but worried about your credit score? You’re not alone. Many Americans face financial hurdles due to past credit challenges, but that doesn’t mean you’re out of options. Today, more lenders recognize that a low credit score isn’t the full story—and they’re offering flexible solutions to help you access money when it matters most.

A poor credit history might feel like a roadblock, but it doesn’t have to stop you from securing the support you need. Whether it’s covering unexpected bills, consolidating debt, or handling life’s curveballs, financial tools exist to bridge the gap. This guide will show you how modern lending works, even if your credit isn’t perfect.

We’ll break down the steps to find lenders who prioritize your current situation over past mistakes. You’ll learn practical strategies to strengthen your application and discover loan types designed for rebuilding credit. With the right approach, you can turn this opportunity into a fresh start for your finances.

Key Takeaways

- Bad credit doesn’t eliminate your chances of approval—many lenders specialize in unique credit situations

- Flexible loan options exist for debt consolidation, emergencies, and other financial needs

- Understanding lender requirements helps you choose the best fit for your circumstances

- Simple strategies can improve your approval odds, even with a low credit score

- Comparing offers ensures you get fair rates and manageable repayment terms

Understanding Personal Loans

Financial tools come in many forms, but few match the adaptability of lump-sum borrowing solutions. These arrangements let you access cash for nearly any purpose, from handling surprise bills to upgrading your living space. Unlike specialized financing for homes or vehicles, these resources put you in control of how funds get used.

Core Components to Know

Two main categories exist: those requiring collateral and those that don’t. Unsecured types don’t demand assets like cars or savings accounts as security. This makes them accessible but often comes with stricter approval criteria. Secured versions use valuables to back the agreement, which can help applicants with credit challenges.

Comparing Your Choices

Loan amounts usually start around $1,500 and reach up to $20,000, with repayment windows spanning 2-5 years. Lenders like OneMain provide both options, letting borrowers pick what aligns with their circumstances. Here’s how they stack up:

| Type | Collateral Needed? | Typical Amounts | Term Lengths |

|---|---|---|---|

| Secured | Yes | $1,500-$20,000 | 24-60 months |

| Unsecured | No | $1,000-$50,000 | 12-84 months |

Secured agreements often mean better rates for those rebuilding credit, while unsecured plans offer faster access without risking assets. Your current financial picture determines which path makes sense. Always compare multiple offers to find terms that match your budget.

Impact of Bad Credit History on Loan Applications

Lenders weigh your financial track record heavily when reviewing requests. Three-digit numbers like FICO® Scores often act as gatekeepers, shaping what options become available. Let’s explore how these details shape outcomes and what hurdles applicants frequently face.

How Credit Scores Influence Approval

Most institutions use credit scores as a snapshot of reliability. Higher numbers signal lower risk, while lower digits may trigger stricter requirements. Here’s how typical ranges affect approval odds:

| Score Range | Approval Likelihood | Typical Terms |

|---|---|---|

| 300-579 | Low | Higher rates, collateral often required |

| 580-669 | Moderate | Average rates, possible fees |

| 670+ | High | Best rates, flexible terms |

Recent applications or maxed-out cards can dent your score temporarily. Lenders also check payment patterns and debt-to-income ratios to gauge repayment capacity.

Common Credit Challenges

Many applicants struggle with these recurring issues:

- Late payments lingering on reports for 7 years

- Balances exceeding 30% of available limits

- Bankruptcies or foreclosures within the past decade

- Thin files with fewer than 3 active accounts

While these factors complicate approvals, specialized lenders focus on current income and stability. Some even report timely payments to credit bureaus, helping rebuild profiles over time.

How personal loans Can Help Overcome Credit Challenges

Rebuilding financial stability often starts with finding the right tools. Modern lending solutions now adapt to various credit situations, offering tailored options for those working to improve their financial standing.

Customized Solutions for Unique Situations

Specialized lenders recognize that credit challenges don’t define financial potential. Many institutions provide products specifically designed for applicants with imperfect histories. These arrangements focus on current income and repayment capacity rather than past setbacks.

Flexible repayment timelines let borrowers align payments with their budget. Options range from 12-month plans to 5-year schedules, helping manage cash flow effectively. Consider these key features:

| Loan Feature | Benefit | Impact |

|---|---|---|

| Adjustable Terms | Match payments to income cycles | Reduces default risk |

| Rate Comparisons | Find competitive offers | Saves money long-term |

| Credit Reporting | Timely payments boost scores | Improves future options |

Smart borrowers compare multiple offers to secure favorable rates. While credit history affects pricing, many lenders provide reasonable terms for those demonstrating financial responsibility. Automatic payments often unlock additional discounts.

Strategic borrowing amounts help address specific needs without overextending budgets. Smaller amounts with shorter terms can rebuild credit faster when managed properly. This approach creates momentum toward stronger financial health.

Understanding these options puts control back in borrowers’ hands. With careful planning and consistent payments, flexible financing becomes a stepping stone toward lasting credit improvement.

Benefits of Securing a Personal Loan Despite Credit Issues

Financial setbacks don’t have to leave you stranded. Modern lending solutions bridge gaps between urgent needs and credit history limitations, offering practical ways to regain control.

Access to Funds for Immediate Needs

When emergencies strike—like medical bills or car repairs—quick access to funds becomes critical. Many institutions now prioritize current financial stability over past credit missteps. Citi® offers solutions with fixed payments and no hidden fees, letting borrowers address surprises without added stress.

Opportunities for Debt Consolidation

Combining multiple high-interest balances into one manageable payment can transform your financial landscape. This strategy often lowers overall interest costs and simplifies budgeting. Here’s how it works:

| Before Consolidation | After Consolidation |

|---|---|

| 4-5 payments monthly | Single fixed payment |

| APRs up to 29.99% | Rates as low as 11.49% |

| Variable due dates | One predictable deadline |

Key advantages include:

- Reduced monthly obligations by up to 40%

- Potential credit score improvements through consistent payments

- Freedom from juggling multiple creditor deadlines

Whether covering unexpected expenses or streamlining existing debt, these tools provide breathing room. As one financial advisor notes:

“Consolidation turns chaos into clarity—one payment, one rate, one path forward.”

Essential Factors Lenders Evaluate

Understanding what lenders prioritize helps applicants present their strongest case. While credit history matters, institutions like Discover review multiple indicators of financial responsibility.

Stability and Attention to Detail

Most lenders start with basic requirements. Discover applicants must:

- Hold a valid U.S. Social Security number

- Be at least 18 years old

- Show $25,000+ in annual income

- Provide verifiable physical address

Steady employment and consistent earnings demonstrate repayment capacity. Lenders analyze pay stubs, tax returns, and job tenure. Application accuracy proves crucial—discrepancies between documents and forms often trigger delays.

Beyond the Credit Report

While credit scores influence decisions, lenders dig deeper. Payment history patterns reveal financial habits better than three-digit numbers. Multiple recent applications (called “hard inquiries”) raise red flags about cash flow stress.

| Factor | Why It Matters |

|---|---|

| Income Sources | Shows repayment resources |

| Debt-to-Income Ratio | Indicates budget flexibility |

| Credit Utilization | Reflects spending discipline |

As one underwriter explains:

“We look for responsible money management, not perfection.”

Knowing these criteria helps applicants address weaknesses before applying.

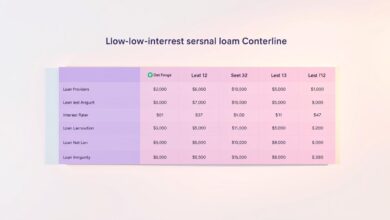

Exploring Top Lender Offers and Flexible Terms

Navigating lender offers requires understanding key differences in rates, terms, and eligibility. Three major providers—Discover, Citibank, and OneMain—each bring unique advantages to the table. Let’s break down their standout features.

Highlights from Leading Lenders

Discover stands out with no fees and extended repayment windows. Their APR range of 7.99%-24.99% accommodates various credit profiles, while 36-84 month terms help balance monthly budgets. Citibank offers slightly higher starting rates at 8.99% APR but caps maximum rates lower than competitors at 19.49%.

| Lender | APR Range | Term Options | Special Features |

|---|---|---|---|

| Discover | 7.99%-24.99% | 3-7 years | Zero fees |

| Citibank | 8.99%-19.49% | 1-5 years | Fast approval |

| OneMain | 18.00%-35.99% | 2-5 years | Bad credit focus |

Decoding Costs and Timelines

While Discover eliminates fees entirely, other lenders might charge origination costs. OneMain’s higher rates (18%-35.99% APR) reflect their specialization in serving borrowers rebuilding credit. Their $1,500-$20,000 amounts suit targeted financial needs rather than large-scale projects.

Term length dramatically impacts affordability. A 60-month plan at Citibank could cut monthly payments nearly in half compared to their 12-month option. As financial expert Laura Gibson notes:

“Choosing longer terms lowers immediate strain but increases total interest—balance both factors carefully.”

Always compare multiple offers. Even small rate differences can save hundreds over time, especially when combined with favorable fee structures.

Using Personal Loans for Debt Consolidation and Home Improvements

Tired of juggling multiple high-interest payments? Strategic financial moves can turn chaos into control. Whether streamlining debt or upgrading your living space, smart funding choices create stability.

Simplify Your Financial Picture

Consolidating credit card balances could save thousands in interest. Citibank® offers fixed-rate solutions that replace scattered payments with one predictable monthly bill—no hidden fees. Their debt consolidation calculator helps visualize potential savings before applying.

Key advantages include:

- Interest rates often 50% lower than credit cards

- Fixed timelines (1-5 years) for clear payoff dates

- Automatic payment options to avoid missed deadlines

Transform Your Living Space

Major home projects become manageable with fixed-rate financing. Unlike variable home equity lines, these arrangements offer stability—you’ll know exactly what you owe each month. Compare funding options:

| Project Type | Credit Card APR | Loan APR |

|---|---|---|

| Kitchen Remodel | 18.24% avg | 11.49%-19.49% |

| Roof Replacement | 22.99% avg | 8.99%-24.99% |

As financial planner Mia Torres notes:

“Structured repayment plans prevent renovation debt from lingering for decades.”

Responsible borrowing for improvements can boost property value while maintaining budget control.

Improving Eligibility and Boosting Your Credit Score

Building stronger financial foundations starts with actionable credit strategies. Small, consistent efforts can reshape your financial profile, opening doors to better opportunities. Let’s explore proven methods to enhance your standing and craft applications that stand out.

Practical Tips for Enhancing Your Credit

Reducing credit card balances below 30% of limits often yields quick results. This lowers your utilization ratio—a key factor in scoring models. Dispute errors on reports through AnnualCreditReport.com; 1 in 5 Americans find mistakes affecting their scores.

| Action | Timeframe | Score Impact |

|---|---|---|

| Pay 2 cards to $0 balance | 1-2 months | +15-40 points |

| Fix reporting errors | 30-45 days | +20-100 points |

| Set payment reminders | Ongoing | +10/month |

Automatic payments prevent missed deadlines. Even $5 above minimums shows proactive management. As credit expert David Rivera advises:

“Treat every payment like rent—non-negotiable and prioritized.”

Preparing a Strong Loan Application

Gather three months of pay stubs and recent tax returns. Lenders verify income stability through consistent deposits and employment history. Avoid new credit inquiries for 90 days before applying—each hard check can dip scores by 2-5 points.

Key documents to organize:

- Recent bank statements

- Government-issued ID

- Utility bills proving residency

Patience pays. Improving your credit score by 50 points could slash interest rates by 3-5%. That $10,000 application might cost $1,200 less over three years with better terms.

Deciphering Loan Terms, Rates, and Payment Calculations

Understanding the numbers behind borrowing can save you thousands. Let’s break down how rates, fees, and timelines shape your financial commitment.

Breaking Down Costs and Timelines

APR (annual percentage rate) combines interest and fees into one figure. For example, a $20,000 agreement at 8.99% APR over 60 months costs $415 monthly, totaling $24,900. Origination fees—often 1%-6%—get rolled into this rate.

Compare two scenarios:

- $10,000 for 36 months at 15.99% APR = $351.52/month

- Same amount at 10% APR = $322.67/month

Small rate differences add up fast. Always ask lenders for full cost breakdowns before deciding.

Smart Tools for Smarter Choices

Online calculators let you test scenarios instantly. Plug in your credit score, desired amount, and term length to estimate:

- Monthly payments

- Total interest costs

- How term changes affect budgets

Adjust one variable at a time. Extending a 3-year plan to 5 years might lower payments 30%, but increase total interest by 45%.

Knowledge transforms borrowing from stressful to strategic. With clear math and smart tools, you’ll find terms that fit your goals and budget.