Home Loans: Simplify Your Mortgage Process

Navigating the world of property financing doesn’t have to feel overwhelming. This guide breaks down modern strategies to help you secure tailored solutions that align with your financial goals. Whether you’re a first-time buyer or refinancing, understanding today’s lending options can turn a complex process into a smooth experience.

Today’s mortgage landscape offers tools designed to save time and reduce stress. From digital applications to rate comparison platforms, lenders now prioritize transparency and efficiency. These innovations let you focus less on paperwork and more on finding the right fit for your budget.

Choosing a trusted partner makes all the difference. A skilled advisor provides personalized advice, helping you evaluate fixed-rate versus adjustable options or government-backed programs. Their expertise ensures you avoid costly pitfalls while building equity over time.

Ready to take control? This resource equips you with actionable steps to compare offers, improve credit readiness, and negotiate terms confidently. Knowledge is power—and with the right approach, your dream property becomes an achievable milestone.

Key Takeaways

- Modern tools simplify comparing rates and loan types

- Expert guidance helps match mortgages to your financial situation

- Digital platforms streamline application processes

- Understanding terms prevents long-term financial stress

- Strategic preparation boosts approval chances

Overview of the Mortgage Journey

Understanding each phase of your mortgage can transform a complex process into a manageable adventure. Modern tools and clear guidance help you navigate requirements while staying focused on your goals. Let’s explore how preparation and teamwork create stress-free progress.

Understanding the Mortgage Process

Lenders review three main factors: income stability, credit history, and existing debts. They’ll ask for pay stubs, tax returns, and bank statements. This verification ensures you can handle monthly payments without strain.

Your debt-to-income ratio (DTI) plays a big role. Most lenders prefer DTIs below 43%. If yours is higher, strategic planning can improve your approval odds.

| Phase | Timeline | Key Tasks |

|---|---|---|

| Pre-Approval | 1-3 Days | Submit financial documents |

| Processing | 2-4 Weeks | Property appraisal, title search |

| Underwriting | 3-7 Days | Final risk assessment |

| Closing | 1 Day | Sign paperwork, receive keys |

Your Step-by-Step Guide

Start by gathering essential documents like W-2 forms and proof of assets. A checklist prevents last-minute scrambles. Pro tip: Save digital copies for quick sharing.

Loan officers and underwriters become your allies. They explain specific conditions like rate locks or insurance needs. Regular communication keeps your application moving smoothly.

Finally, plan for contingencies. Market shifts or appraisal delays might adjust your timeline. Staying flexible helps you adapt while maintaining financial stability.

Understanding Home Loans

Breaking down mortgage fundamentals can empower buyers to make informed decisions with confidence. Today’s lending solutions balance flexibility with security, creating pathways for diverse financial situations.

What Are Home Loans?

Mortgages let you purchase property by using the asset itself as collateral. This security allows lenders to offer competitive rates while protecting their investment. You’ll find multiple options, including:

| Type | Credit Score Minimum | Down Payment | Best For |

|---|---|---|---|

| Conventional | 620 | 3-20% | Strong credit profiles |

| FHA | 580 | 3.5% | First-time buyers |

| VA | Varies | 0% | Military families |

| USDA | 640 | 0% | Rural properties |

Benefits of a Streamlined Mortgage Process

Modern lenders use automated systems to slash approval times. Did you know? Some platforms now deliver pre-approval letters in under 24 hours. This speed helps you act fast in competitive markets.

Streamlined processes also simplify comparing offers. Many providers showcase rates and terms side-by-side. You’ll spend less time hunting for details and more time evaluating what fits your budget.

These improvements benefit all credit situations. Whether rebuilding your score or boasting excellent history, efficient systems match you with viable options. The result? Less stress and clearer paths to your property goals.

Navigating Mortgage Insurance and Interest Rates

Securing the right financing involves understanding two critical components: protection for lenders and costs for borrowers. Let’s break down how insurance requirements and rate fluctuations impact your long-term budget.

Mortgage Default Insurance Explained

Putting down less than 20%? You’ll need default insurance. This safety net protects lenders if payments stop, but doesn’t remove your responsibility. Even if the insurer covers a loss, you’re still liable for any remaining balance after a property sale.

High-value purchases face stricter rules. Starting December 2024, properties over $1.5 million won’t qualify for this coverage. Buyers must provide at least 20% upfront in these cases.

Factors Influencing Interest Rates

Your credit score and loan-to-value ratio heavily affect your interest rate. Lenders reward lower-risk profiles with better terms. Market competition and Federal Reserve policies also sway available options.

Choosing between fixed-rate and variable-rate options impacts payment stability. Fixed terms lock in predictability, while variable terms might save money if market interest rates drop. Timing your application during rate dips can lead to significant savings over time.

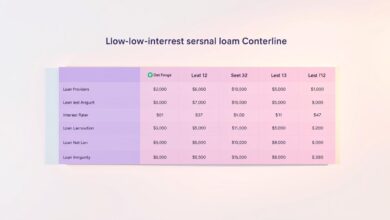

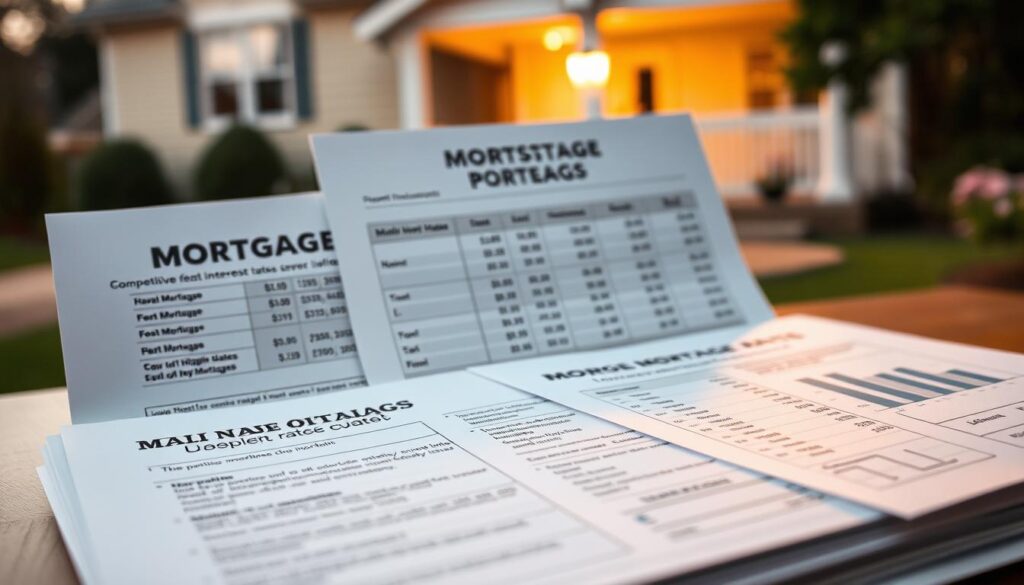

Exploring Competitive Mortgage Offers

Smart borrowers know that mortgage shopping goes beyond just comparing numbers. Today’s lenders sweeten deals with perks like cash back incentives—CIBC, for example, provides immediate funds at closing with select mortgages. These offers turn upfront costs into opportunities while maintaining competitive terms.

Fixed-rate options remain popular for their predictability. A 5-year term locks in stability, while 7-year agreements extend budget certainty. Always check the APR (annual percentage rate) to understand true borrowing costs—not just the advertised interest rate.

Comparison tools simplify evaluating multiple proposals. Look beyond rates to assess prepayment flexibility, penalty structures, and customer support quality. Pro tip: Lenders often compete by offering unique programs like accelerated payment schedules or loyalty discounts.

Personalized advice becomes crucial when navigating these choices. Mortgage experts help match your goals with suitable terms, whether prioritizing low fees or long-term savings. They’ll also highlight timing opportunities—like applying when mortgage rates dip—to maximize value.

Market competition works in your favor. As institutions innovate to attract clients, you gain access to better rates and creative solutions. Stay informed, compare thoroughly, and let modern tools streamline your path to the ideal offer.

Leveraging Home Equity for Financial Flexibility

Your property isn’t just a place to live—it’s a powerful financial tool waiting to be unlocked. Equity represents the gap between your residence’s market value and what you still owe on it. As you pay down your mortgage and property values rise, this resource grows into a versatile asset for achieving life goals.

How Equity Accumulates

Every mortgage payment chips away at your principal balance, while market trends can boost your property’s worth. Tools like RBC’s value estimator help track these changes, showing exactly how much untapped potential you’ve built. For example, a $500,000 property with $300,000 remaining on the mortgage holds $200,000 in usable equity.

Smart Ways to Use Your Equity

A home equity line of credit (HELOC) lets you borrow against this value at lower rates than most credit cards. Popular uses include:

- Renovations that increase property value

- Consolidating high-interest debt

- Funding education or business ventures

These options often come with tax advantages—consult a financial advisor to maximize benefits. Remember to maintain at least 20% equity as a safety net against market shifts. Strategic use turns your property’s hidden value into a springboard for growth without risking your housing stability.

Expert Advice for First-Time Home Buyers

Starting your journey toward owning a residence requires smart preparation. Many lenders now offer tailored tools and guides specifically designed for new purchasers. These resources help simplify complex decisions while building confidence in your choices.

Essential Steps for Your Mortgage Application

Gather critical documents early to avoid delays. Lenders typically request:

| Document Type | Purpose | Time to Collect |

|---|---|---|

| Pay Stubs (2 months) | Verify income stability | 1-3 Days |

| Tax Returns (2 years) | Assess annual earnings | 3-7 Days |

| Bank Statements | Confirm savings/assets | Instant (digital) |

| Credit Report | Evaluate borrowing risk | 24 Hours |

Pre-approval strengthens your negotiating power. It shows sellers you’re serious and financially ready. Pro tip: Update your credit profile 6 months before applying—pay down debts and resolve errors.

Key Questions to Ask When Buying Your First Home

Clarify these details with lenders:

- What closing cost assistance programs exist?

- Are there penalties for early repayment?

- How often can I adjust payment amounts?

Explore regional incentives like down payment grants or tax credits. Partnering with experienced advisors helps uncover these opportunities while avoiding common missteps.

Streamlining Your Mortgage Renewal and Management

Mortgage renewal isn’t just paperwork—it’s a financial reset button. As your current term nears expiration, you gain the chance to reassess rates, adjust payment structures, and align with evolving goals. Proactive planning here can unlock better terms and long-term savings.

Understanding the Renewal Process

Lenders typically send renewal notices 21-45 days before your term ends. This window lets you gather updated income documents and credit reports. “Reviewing offers from multiple institutions often reveals better rates,” notes financial advisor Rachel Torres.

Compare fixed versus variable rate options carefully. Current economic trends might favor one over the other. Use online calculators to project total costs under different scenarios.

Effective Strategies for Mortgage Management

Accelerate equity growth through prepayment privileges. Many agreements allow annual lump sums up to 20% of the original balance. Increasing payment frequency—like switching from monthly to biweekly—reduces interest costs over time.

“Treat your mortgage like a living document. Annual reviews prevent missed opportunities for rate improvements or debt reduction.”

Digital dashboards from lenders help track amortization schedules and equity milestones. Set alerts for rate drop notifications to time refinancing moves strategically.

Conclusion

Securing your ideal property begins with smart financial strategies. By combining thorough preparation with modern tools, you transform the mortgage process from daunting to manageable. Each step—from document organization to rate comparisons—builds toward a stronger position.

Partnering with experienced professionals makes this journey smoother. These experts provide personalized advice that aligns with your income and goals. Their guidance helps navigate complex decisions while avoiding common pitfalls.

Take action by making an appointment with a mortgage specialist. Discussing your objectives early creates a roadmap tailored to your needs. Getting pre-approved not only clarifies your budget but demonstrates seriousness to sellers.

Remember, long-term success starts with a strategic plan. A well-structured mortgage adapts as your life evolves, whether through refinancing or equity-building. Regular reviews keep financing aligned with market changes.

With the right support, property ownership becomes an empowering achievement. Make an appointment today—your dream residence awaits, backed by a plan designed for lasting stability.