Instant Loans Online: Fast Approval & Funding

Unexpected expenses don’t wait for payday. When you need quick financial support, online solutions offer a modern alternative to traditional banks. These services prioritize speed and simplicity, letting you apply from your couch instead of waiting in line at a branch.

Many platforms now deliver decisions within minutes. Once approved, funds often reach your account in as little as one business day. This rapid process eliminates weeks of paperwork delays common with conventional lenders.

Over 12 million U.S. households used similar services last year to manage emergencies or planned costs. The digital approach removes physical barriers, making financial help accessible whether you’re at home or on the go.

This guide explains how these services work. You’ll learn about eligibility criteria, application steps, and repayment flexibility. We’ll also cover how to compare options while avoiding common pitfalls.

Modern platforms focus on user experience, offering clear terms and responsive support. By the end, you’ll know how to secure funds responsibly while keeping your financial goals on track.

Key Takeaways

- Digital applications often provide approval decisions within minutes

- Funds typically arrive in accounts within 24 hours of approval

- No physical branch visits required for most online services

- Over 12 million Americans used similar financial solutions last year

- Compare multiple lenders to find favorable rates and terms

- Clear repayment plans help maintain financial stability

Overview of Instant Loans Online

When cash is needed urgently, digital lending platforms rise to the occasion. These services provide a modern solution for managing sudden car repairs, medical bills, or home emergencies. Their round-the-clock availability means help arrives precisely when traditional banks shut their doors.

Service Benefits and Fast Funding

Automated systems handle requests day and night, cutting approval times to minutes instead of days. Once approved, money reaches your account through secure methods like Interac e-Transfer—often in under five minutes. This efficiency stems from simplified paperwork that focuses only on essential details.

Unlike brick-and-mortar lenders, online platforms skip physical document checks. This reduces processing costs and speeds up decisions. Many users report completing the entire process during lunch breaks or late-night emergencies.

Why Choose a Digital Application?

Digital requests eliminate commuting and waiting rooms. You can submit forms from any device while balancing work or family time. Modern platforms also offer transparent terms upfront, letting you compare options without pressure.

| Features | Digital Lenders | Traditional Banks |

|---|---|---|

| Availability | 24/7 access | Business hours only |

| Funding Speed | Minutes-hours | 3-7 business days |

| Documentation | Basic requirements | Extensive paperwork |

This streamlined approach helps maintain financial stability during crunch times. With flexible repayment plans and clear fee structures, borrowers can address immediate needs without long-term stress.

What Are Instant Loans?

Modern financial tools fill gaps left by conventional banking. These solutions prioritize speed and accessibility, offering a lifeline when time-sensitive needs arise. Unlike standard options, they focus on current circumstances rather than past financial history.

Definition and Key Features

Short-term financial products bridge cash shortages between paychecks. They’re designed for urgent situations like medical bills or car repairs. Approval often hinges on income stability rather than strict credit scores.

Advanced algorithms analyze thousands of data points traditional lenders ignore. Employment patterns, banking habits, and bill payments paint a clearer picture of reliability. This approach helps people with non-traditional income sources qualify when banks say no.

Comparison to Traditional Lending

Brick-and-mortar institutions rely heavily on credit reports and collateral. Digital platforms use dynamic criteria that adapt to individual situations. Here’s how they stack up:

| Factor | Modern Solutions | Conventional Banks |

|---|---|---|

| Approval Time | Minutes to hours | 5-10 business days |

| Documentation | Bank statements & ID | Tax returns, collateral proof |

| Credit Checks | Alternative scoring | FICO-focused |

| Accessibility | 24/7 applications | Branch hours only |

This streamlined process benefits gig workers, freelancers, and those rebuilding credit. Transparent terms help borrowers understand costs upfront, avoiding surprises down the road.

Eligibility and Application Requirements

Financial solutions should adapt to your life, not the other way around. Modern platforms use straightforward criteria to help working adults access funds quickly. Let’s break down what you’ll need to get started.

Minimum Age and Banking History

You must be at least 19 years old to apply. Lenders also review your bank account history from the last six months. This shows consistent income deposits and responsible money management.

Steady employment matters too. Most services require:

| Factor | Online Lenders | Traditional Banks |

|---|---|---|

| Minimum Age | 19 years | 18-21 years |

| Bank History | 6 months | 12+ months |

| Employment | Local job | Any location |

| Monthly Income | $1,000+ | $3,000+ |

Required Documentation Overview

Gathering your documents takes minutes, not days. You’ll typically need:

- Recent bank statements (PDF or digital copies)

- Pay stubs or employment verification

- Government-issued photo ID

These requirements focus on your current financial capacity rather than past credit challenges. Digital submission means no fax machines or office visits. Upload files directly through secure portals for instant review.

This inclusive approach helps over 60% of applicants get approved on their first try. Clear guidelines ensure you know exactly what’s needed before starting your application.

Simple and Quick Application Process

Starting your financial journey shouldn’t feel like running a marathon. Modern platforms cut through complexity with intuitive forms that guide you step-by-step. Most applicants finish in 5-10 minutes—faster than brewing coffee.

The streamlined design asks only essential questions. Clear prompts help avoid errors, while smart fields auto-fill basic details. One user shared:

“It felt like the form knew what I needed before I typed it”

Document uploads take seconds. Snap photos of your ID or bank statements using your phone, or drag files into the portal. Secure encryption protects every upload, balancing speed with safety.

| Step | Digital Process | Traditional Method |

|---|---|---|

| Form Completion | 5-10 minutes | 45+ minutes |

| Document Submission | Instant upload | In-person/email |

| Status Updates | Real-time dashboard | Phone follow-ups |

Track progress through a mobile-friendly dashboard that updates like a food delivery app. Receive alerts when lenders review your details or request additional information. This transparency helps you plan next steps confidently.

Every screen adapts perfectly to smartphones, tablets, or desktops. Whether you’re commuting or cooking dinner, the time-sensitive process moves at your pace. Rest assured—simplicity never compromises thorough verification checks.

Instant Loans for Bad Credit Customers

Financial challenges shouldn’t define your options. Modern solutions recognize that past credit scores don’t always reflect current stability. Many services now prioritize your present financial behavior over historical missteps.

Modern Evaluation Methods

Advanced systems analyze bank activity patterns instead of traditional reports. They track income deposits, bill payments, and spending habits. One user noted:

“They looked at my actual cash flow instead of old collection notices”

This approach helps those rebuilding credit after medical bills or job changes. Employment consistency and recent financial responsibility weigh heavier than a single number.

Alternative Approval Pathways

Some options skip credit checks entirely. Decisions focus on:

| Evaluation Factor | Modern Approach | Traditional Method |

|---|---|---|

| Income Verification | 3 months bank statements | Tax documents |

| Debt Assessment | Current obligations | Historical reports |

| Risk Prediction | Spending patterns | Credit bureau data |

This method benefits gig workers and freelancers with non-traditional income streams. Over 40% of approved applicants had credit scores below 600 last quarter.

Focus on what you control now—consistent earnings and responsible money management. Many find this approach more forgiving than conventional payday loan requirements. Your next smart financial decision could start today.

Approval Speed and Funding Within Minutes

Time-sensitive financial needs demand solutions that match their urgency. Modern platforms deliver decisions faster than ordering pizza, with funds arriving before traditional lenders finish their first coffee break.

Automated Approval Process

Advanced algorithms analyze applications right away, skipping lengthy manual reviews. These systems check income patterns and banking behavior instead of outdated credit reports. One satisfied user shared:

“My approval came through before I could check my email spam folder”

This technology eliminates paperwork delays while maintaining strict security standards. The system operates 24/7, approving requests during night shifts or holiday emergencies when banks are closed.

Interac e-Transfer Delivery Method

Approved funds arrive through secure digital transfers most Americans already use daily. Here’s how it compares to old-school methods:

| Feature | Digital Transfer | Bank Wire |

|---|---|---|

| Speed | Within 5 minutes | 1-3 business days |

| Availability | 24/7 including weekends | Bank hours only |

| Confirmation | Instant notification | Manual tracking |

This method lets you address car repairs or medical bills immediately. Funds become available for withdrawal or spending as soon as you accept the transfer notification.

While speedy, the process still verifies essential details through encrypted channels. You get both efficiency and thorough financial checks—no compromises on security for convenience.

Flexible Payment Plans to Suit Your Needs

Managing your money shouldn’t feel like solving a puzzle. Modern platforms adapt to your income rhythm rather than forcing rigid deadlines. This approach keeps your budget intact while fulfilling financial commitments.

Next Payroll Repayment Options

Most borrowers prefer aligning payments with their upcoming payday. This standard plan lets you clear balances when fresh income arrives. Over 70% of users choose this method for its simplicity and natural cash flow alignment.

Customized Schedule Flexibility

Need more breathing room? Spread payments across 2-3 pay periods at no extra cost. Here’s how it compares:

| Feature | Standard Plan | Extended Plan |

|---|---|---|

| Payment Period | Next payday | 2-3 pay cycles |

| Interest Charges | None | None |

| Eligibility | Automatic | Contact support |

One customer shared:

“They worked with my freelance income schedule—no stress about fixed dates”

Support teams can create hybrid schedules for unique situations. Whether you need smaller installments or adjusted due dates, solutions exist. Transparent terms mean no surprise fees—you’ll see all costs before confirming.

Open communication helps maintain financial health. Reach out through secure messaging or phone to discuss options. Trained specialists focus on sustainable plans rather than pushing unrealistic timelines.

Security & Encrypted Information

Your sensitive details deserve fortress-like protection in today’s digital world. Leading platforms use military-grade safeguards to shield your private information from cyber threats. Let’s explore how advanced technologies keep your financial life secure.

Bank-Level Security Protocols

Every data exchange uses AES-256 encryption—the same standard protecting government communications. This technology scrambles information during transmission, making it unreadable to unauthorized parties. Real-time monitoring systems watch for suspicious activity 24/7.

Stored information gets triple protection:

- Biometric access controls for staff

- Regularly rotated encryption keys

- Firewalled servers in secure facilities

Multi-factor authentication adds extra defense layers. You might verify logins through:

| Verification Method | Digital Platforms | Traditional Banks |

|---|---|---|

| Biometric Scan | Yes | Rarely |

| One-Time Codes | Always | Sometimes |

| Security Questions | Optional | Required |

One user shared their experience:

“The security features made me feel safer than my neighborhood bank branch”

Platforms undergo annual audits by independent cybersecurity firms. Updates roll out weekly to counter new threats. These measures meet strict standards including PCI DSS and GDPR compliance.

Your privacy remains protected even after closing accounts. Data retention policies automatically purge unnecessary details while maintaining required records. Rest easy knowing your trust drives every security decision.

User-Friendly Digital Signing Process

Signing financial agreements shouldn’t require a printer or fax machine. Modern platforms let you complete the entire process through secure digital channels. This approach saves time while maintaining legal validity and security standards.

E-signature Convenience

Electronic signatures work like digital fingerprints for your contracts. They carry the same legal weight as handwritten ones under U.S. ESIGN Act guidelines. Simply click or tap to initial required fields—no paper shuffling needed.

The interface highlights sections needing attention with color-coded prompts. One borrower shared:

“It walked me through each clause like a helpful guide—no confusing jargon”

| Feature | Digital Signing | Traditional Method |

|---|---|---|

| Time Required | 2-4 minutes | 3+ business days |

| Device Access | Any smartphone/computer | Printer/scanner required |

| Security Level | 256-bit encryption | Physical document risks |

Instant Contract Acceptance

Approved agreements activate funding immediately after signing. The system verifies your identity through multi-factor checks during the process. Funds release automatically once all parties complete their sections.

This method works whether you’re at home, work, or traveling. Postal delays and office wait times become relics of the past. Your rights and protections remain identical to paper-based contracts—just without the filing cabinet.

Digital efficiency doesn’t cut corners. Audit trails track every action, from signature placement to final submission. You’ll receive confirmation emails with downloadable copies for your records.

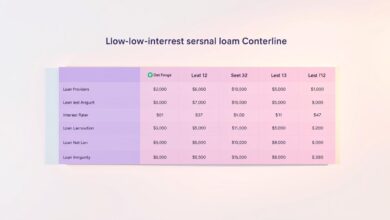

Transparent Lending Criteria and Rates

Understanding your borrowing costs shouldn’t require a finance degree. Reputable services lay out all fees and rates upfront, helping you make informed decisions without guesswork. This clarity builds trust and prevents surprises down the road.

Interest Rates and Fee Structure

Costs typically range between $14-$15 per $100 borrowed, varying slightly by location. These fees reflect the short-term nature of the service—unlike traditional annual percentage rates designed for multi-year agreements.

Cost Per $100 Borrowed Explained

Let’s break down a $500 agreement over 14 days. You’d pay $70 in fees (14 x $5 per $100), totaling $570 repayment. While the 365% APR seems high, it’s competitive for 14-day terms compared to industry alternatives.

Platforms emphasize transparent terms over complex calculations. You’ll always see the exact repayment amount before confirming—no hidden charges or last-minute adjustments. This approach helps maintain financial control while addressing urgent needs.