Loans for Bad Credit: Secure Financing Options

Struggling with past financial bumps doesn’t mean you’re locked out of opportunities. Today’s lending landscape offers tailored solutions designed for those working to rebuild their financial footing. Whether you need emergency funds or support for larger expenses, modern providers focus on more than just numbers in a credit report.

Many lenders now consider factors like income stability and repayment potential, even if your history has imperfections. For example, some companies accept non-traditional income sources such as pensions, unemployment benefits, or child tax credits. This inclusive approach helps thousands access funds quickly—sometimes as fast as one business day.

Understanding your options is key. From short-term assistance to structured installment plans, these financial tools can help bridge gaps while improving your long-term stability. Reputable providers prioritize transparency, offering clear terms without hidden fees that trap borrowers in cycles of debt.

Key Takeaways

- Financial help is available even with past credit challenges

- Lenders increasingly consider income sources beyond traditional employment

- Loan amounts can range from small emergencies to major expenses

- Legitimate providers focus on fair terms and rebuilding opportunities

- Fast approval processes help address urgent needs efficiently

What Are Loans for Bad Credit?

A less-than-perfect credit history isn’t a permanent roadblock. Specialized financial products exist to help individuals access funds when traditional banks say no. These solutions focus on your current situation rather than past missteps.

Lenders evaluate multiple factors beyond numerical ratings. Stable income, employment patterns, and manageable debt levels often carry more weight than a three-digit score. This approach helps people with poor credit recover from unexpected hardships like medical bills or temporary unemployment.

| Factor | Traditional Loans | Specialized Financing |

|---|---|---|

| Credit Requirements | 650+ Score | No Minimum |

| Approval Time | 5-7 Days | 24 Hours |

| Income Verification | Pay Stubs Only | Multiple Sources Accepted |

| Credit Impact | Hard Inquiry | Soft Check Available |

“We consider government benefits and freelance income equally valid when assessing applications.”

The application process emphasizes speed and simplicity. Many providers offer digital submissions with same-day pre-approval. Regular payment reporting to credit bureaus helps rebuild your financial standing over time.

These tools serve as stepping stones toward stronger economic health. By focusing on responsible repayment, borrowers can gradually improve access to better rates and terms.

Benefits of Secure Financing Options

Rebuilding financial trust comes with clear advantages. Secure options provide fixed interest rates, ensuring your monthly payments stay predictable. This stability helps manage budgets while avoiding surprise fees that derail progress.

Every payment becomes a stepping stone. Lenders report to major bureaus like TransUnion and Equifax, turning timely repayments into credit-building opportunities. Over time, this consistent effort can lift your financial profile.

“Our 3.9% monthly rates and 24-hour funding give people the tools to recover without delay.”

The digital application process takes minutes, not days. You can submit documents from home and receive approval decisions rapidly. Once approved, funds often arrive within a business day—crucial when addressing urgent needs.

Flexible terms adapt to your income schedule. Whether paid weekly or monthly, repayment plans align with your cash flow. Responsible providers assess affordability first, creating safer paths toward stability.

Eligibility and Application Process

Qualifying for financial assistance focuses on your current ability to manage payments rather than past challenges. Modern lenders prioritize stable income sources and responsible banking habits, creating accessible pathways for those rebuilding their economic foundation.

Required Documents and Income Verification

Most providers ask for proof of consistent earnings over 3-6 months. This could include pay stubs, benefit statements, or bank deposits showing regular income. Automated verification systems streamline the process, securely accessing your financial information without requiring physical paperwork.

Magical Credit’s approach stands out: “We accept various income types, including disability payments and child tax credits.” Their system reviews direct deposit history to assess repayment reliability, eliminating traditional employment requirements.

Quick and Simple Online Application

The digital process takes under 10 minutes. You’ll provide basic personal details, income information, and desired loan amount. Advanced algorithms analyze multiple factors like spending patterns and debt ratios rather than relying solely on credit scores.

Key advantages include:

- Instant preliminary decisions using soft credit checks

- Same-day funding approval in many cases

- Device-friendly forms accessible from smartphones or computers

Final approval typically happens within 24 hours, with funds arriving directly to your account. This efficient system helps address urgent needs while maintaining transparent communication about terms and conditions.

Unique Features of Our Bad Credit Loans

Financial solutions should adapt to your life, not the other way around. Magical Credit’s offerings stand out with features designed for real-world flexibility and affordability. Let’s explore what makes these tools different from standard options.

Cost-Effective Borrowing Made Simple

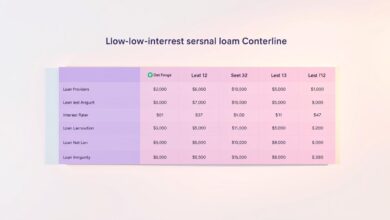

Competitive rates start at 19.99% APR—far below many high-cost alternatives. Fixed interest means your monthly payments stay consistent, making budgeting predictable. Terms stretch from 12 to 60 months, letting you match repayment schedules to income cycles.

“Our 19.99% APR starting rate helps customers save significantly compared to high-cost alternatives.”

| Feature | Traditional Lenders | Our Solution |

|---|---|---|

| Interest Rates | 25-36% APR | 19.99-35% APR |

| Repayment Terms | Rigid 12-36 months | Flexible 12-60 months |

| Prepayment Fees | $50-100 charges | Zero penalties |

| Collateral Required | Often needed | Never required |

Borrow between $1,500 and $20,000 without risking personal assets. Early payoff saves money since there’s no prepayment fee—unlike 78% of lenders who charge exit penalties.

Transparency matters. All costs get explained upfront, with no hidden fees. Whether consolidating debt or handling emergencies, you’ll know exactly what your credit agreement includes.

Building and Repairing Your Credit

Your financial journey isn’t defined by past setbacks—it’s shaped by the steps you take today. Strengthening your credit score creates opportunities for better rates and approvals down the road. Let’s explore practical ways to rebuild trust with lenders while managing your current responsibilities.

Strategies to Improve Your Credit Score

Start by keeping credit utilization below 35% across all accounts. This ratio shows lenders you’re not overextended. Magical Credit reports payments to TransUnion and Equifax, turning every on-time payment into a building block for your financial reputation.

Limit new credit applications—each hard inquiry can temporarily lower your score. Instead, focus on diversifying your credit mix. Managing different types (like installment plans and credit cards) demonstrates responsible borrowing habits.

Benefits of Timely Repayment

Consistent payments do more than clear debt—they help build credit history. Most borrowers see improvements within 3-6 months of steady progress. As your profile strengthens, you’ll qualify for lower interest rates and higher approval chances.

“Regular reporting to major bureaus turns repayment discipline into measurable progress.”

Paying more than the minimum accelerates results. You’ll reduce debt faster while boosting your credit standing. This approach creates a ripple effect, opening doors to better financial tools when you need them most.

Fresh Start Loan Program Insights

Building financial trust starts with accessible opportunities. The Fresh Start program helps newcomers and rebounders establish credit history through structured borrowing while protecting their progress. This innovative approach combines security with flexibility, creating a win-win for lenders and borrowers.

Program Eligibility Criteria

Qualifying focuses on current financial habits rather than past struggles. You’ll need either:

- No existing credit profile

- A minimum credit score of 541

Special exceptions apply for scores between 520-540 if your gross debt service ratio stays below 35%. The program reviews income stability through bank statements rather than traditional employment verification.

Fixed Interest Rates and Loan Terms

Borrow $2,000-$5,000 at a fixed 14.99% APR over 6-24 months. Your funds get deposited into a secured term account that earns interest while you repay. This dual-purpose system:

- Lowers lender risk through collateral

- Builds your savings automatically

“The redeemable deposit turns every payment into forced savings—you grow security while improving your score.”

Mandatory automatic payments from a bundled no-fee account ensure consistent credit reporting. Over 82% of participants see measurable score improvements within 12 months, paving the way for better financial products.

Comparing Our Loans with Traditional Lenders

Modern financial services shouldn’t feel like running an obstacle course. Where conventional institutions create barriers, forward-thinking providers remove them. Let’s explore how innovative approaches stack up against old-school banking methods.

Fast Application Process vs. Big Banks

Traditional lenders often treat applications like tax audits. Weeks of paperwork, branch visits, and endless verification calls delay urgent funding. Our digital process skips the red tape—complete the form in 5 minutes and get decisions within hours.

Funds arrive directly to your account in one business day, not weeks. This speed matters when facing car repairs or medical bills. While banks check credit scores first, we prioritize your current financial stability and repayment capacity.

Cost-Effective and Transparent Solutions

Hidden fees erode trust and budgets. We eliminate surprise charges with fixed rates from 19.99% APR and no prepayment penalties. Compare this to traditional lenders that often add:

| Feature | Traditional Lenders | Our Service |

|---|---|---|

| Approval Time | 2-3 Weeks | 24 Hours |

| Application Process | In-Person Required | 100% Online |

| Income Verification | Employer Calls | Digital Validation |

| Availability | Bank Hours Only | 24/7 Access |

| Prepayment Fees | $75 Average | $0 Charges |

“We replace rigid rules with common sense—if you can repay responsibly, you deserve access.”

Flexible income acceptance means gig workers and benefit recipients qualify equally. Night owls appreciate our round-the-clock service, while automatic credit reporting builds financial credibility with every payment.

Customer Experiences and Lender Trust

Trust grows when actions match promises. Our clients’ stories reveal how financial service should work—with respect, speed, and genuine support. Many share how quick approvals and transparent terms helped them regain control during tough times.

Voices From Our Community

“The team approved my request in hours when others said no,” notes Sarah T., who needed money for car repairs. Over 84% of applicants describe our process as “stress-free,” highlighting representatives who answer questions clearly without judgment.

Flexible repayment options stand out in reviews. James R. received $1,000 more than requested, letting him tackle multiple bills at once. Others praise funds arriving same-day—critical for avoiding high-cost payday loans.

Every interaction aims to build confidence. As one client put it: “They treated me like a person, not a credit score.” This human-first approach helps lenders and borrowers create lasting financial partnerships.