online loans for bad credit – Fast Approval Options

Facing unexpected expenses with a less-than-perfect credit score can feel overwhelming. But today’s financial landscape offers specialized tools designed to help you access funds quickly, even if traditional banks have turned you down. This guide will show you how modern solutions prioritize speed and flexibility over rigid credit checks.

Gone are the days when a low credit rating meant waiting weeks for approval. Companies like Magical Credit now process applications in as little as one business day, offering amounts from $100 to $20,000. Their streamlined online form takes five minutes and accepts various income sources – from pensions to unemployment benefits.

Need immediate cash? Services like My Canada Payday deliver funds within 5 minutes via Interac e-Transfer, available 24/7. These options prove that financial emergencies don’t have to derail your progress. We’ll walk through application tips, repayment strategies, and ways to improve your financial standing while meeting urgent needs.

Key Takeaways

- Specialized lenders now serve those with credit challenges

- Approval decisions can occur within one business day

- Non-traditional income sources are frequently accepted

- Some providers offer 24/7 access to emergency funds

- Loan amounts range from $100 to $20,000

- Electronic transfers can deliver money in minutes

Overview of Online Loans for Bad Credit

Modern financial tools now exist for those who’ve faced rejection from traditional banks. These specialized products help bridge gaps when life throws curveballs, offering tailored support for unique circumstances.

Tailored Support for Unique Situations

These financial products serve individuals with imperfect financial histories. Many applicants include gig economy workers, students building credit, or people rebuilding after medical emergencies. Lenders analyze multiple factors beyond traditional metrics:

| Approach | Traditional Banks | Modern Lenders |

|---|---|---|

| Approval Time | 5-7 days | 24 hours |

| Credit Checks | Hard inquiries | Alternative data |

| Income Sources | W-2 only | Multiple streams |

| Funding Speed | Next week | Same day |

Why Speed Matters in Emergencies

When your car breaks down or pipes burst, waiting days for funds isn’t practical. Quick approvals prevent small issues from becoming crises. Fast-tracked applications help avoid:

- Late rent payments

- Utility shutoffs

- High-interest alternatives

Reputable companies like Magical Credit use advanced systems to review applications holistically. They consider government benefits, freelance income, and even educational background when making decisions.

Remember – responsible borrowing can actually help rebuild your financial standing. Many lenders report timely payments to credit bureaus, creating opportunities to improve your credit score over time.

Online Loans for Bad Credit: Fast and Flexible Approval

Digital platforms have transformed how people access funds during financial crunches. Modern lenders use smart algorithms to review applications in real time – some approvals happen before you finish your coffee. This shift means even those with past credit stumbles can secure support when it matters most.

Take Magical Credit’s approach: Their team reaches decisions within 24 hours by evaluating employment history and banking patterns alongside credit reports. This method helped over 10,000 customers achieve a 4.3-star satisfaction rating. One user shared: “They actually looked at my full story, not just a number.”

Flexibility defines these services. You’ll find:

- Amounts from $200 to $15,000

- Payment plans matching pay cycles

- Income verification through bank links instead of paperwork

Advanced systems automatically cross-check details while live agents stand ready to explain terms. This blend of tech and touch helps applicants feel supported, not screened. Transparent pricing models display all fees upfront – no guessing games about total costs.

The competitive lending landscape pushes companies to improve constantly. Faster approvals, better rates, and personalized solutions keep borrowers coming back. As one industry expert noted: “Speed without compassion is just automation. The best lenders balance both.”

Simple Application Process

Getting financial help shouldn’t feel like running a marathon. Modern solutions cut through the red tape, letting you focus on what matters – resolving your situation quickly.

Five-Minute Online Application

Leading companies like Magical Credit prove speed doesn’t mean cutting corners. Their digital form uses smart design to save time:

- Pre-filled fields for returning users

- Dropdown menus for common answers

- Auto-save functionality if interrupted

You’ll typically share basic details like your name, contact information, and employment status. Banking data gets verified electronically – no faxing pay stubs or tax forms. One recent applicant noted: “I finished during my lunch break and had funds by dinner.”

No Extensive Documentation Required

Gone are the days of hunting down paperwork. Modern systems cross-check information through secure databases instead of manual reviews. See how requirements differ:

| Requirement | Traditional Process | Modern Approach |

|---|---|---|

| ID Verification | Notarized copies | Bank-linked authentication |

| Income Proof | Pay stubs + employer letter | 90-day bank statement analysis |

| Processing Time | 3-5 business days | Under 5 minutes |

This streamlined process helps lenders make faster decisions while reducing applicant stress. My Canada Payday reports 83% of completed applications get submitted outside standard business hours – perfect for night owls and early birds alike.

Whether you’re dealing with car repairs or unexpected medical bills, these user-friendly systems put help within reach. As one financial advisor puts it: “When emergencies strike, simplicity becomes the ultimate sophistication.”

Understanding the Approval Process

Navigating financial approvals becomes simpler when you know how lenders evaluate applications. Modern systems balance efficiency with thoroughness, using smart methods to assess your situation fairly.

Soft vs. Hard Credit Checks

Soft credit checks let lenders peek at your financial history without leaving a mark. Magical Credit uses this approach first, letting them review applications while protecting your credit score. If you qualify, they perform a hard credit check – this temporary dip (usually 3-5 points) gets offset when they report your timely payments to major bureaus.

My Canada Payday takes a different route. Their team skips credit checks entirely, focusing on bank activity patterns instead. As their FAQ states: “We trust your current cash flow more than past missteps.”

Instant Decision Technology

Advanced algorithms now review applications faster than most humans. These systems analyze:

- Income consistency across 90 days

- Bank balance trends

- Debt-to-deposit ratios

Automated approvals work nights and weekends – 62% of My Canada Payday’s applications get processed outside 9-to-5 hours. One borrower shared: “I applied during a midnight panic and had funds by breakfast.”

Transparency remains key. Reputable lenders clearly state when and why they’ll perform credit checks. This openness helps you choose options aligning with your financial rebuilding goals.

Flexible Repayment Terms

Finding the right payment rhythm can turn financial stress into manageable steps. Leading providers now offer multiple scheduling options that adapt to your cash flow rather than forcing rigid deadlines.

Bi-Weekly, Semi-Monthly, and Monthly Payments

Bi-weekly plans split payments every two weeks, aligning with many pay schedules. This approach creates 26 payments annually – equivalent to 13 monthly installments – which can shave months off your repayment term. For a $1,500 loan at 2.9% monthly interest, this method could save $75+ compared to standard monthly payments.

Semi-monthly options sync with common paycheck dates (15th and month-end). Magical Credit users report this timing helps them:

- Budget around fixed expenses

- Avoid overdraft fees

- Maintain emergency savings

Traditional monthly plans remain popular for their predictability. Lenders calculate amounts using three factors:

- Loan principal

- Interest rate

- Chosen repayment duration

Transparency is key. Reputable companies provide clear cost breakdowns upfront – like showing a $525 total interest charge on that $1,500 example. “Knowing exactly what I owed made budgeting easier,” shared one Manitoba borrower.

Most agreements allow adjustments if life throws curveballs. Whether you need to switch payment dates or temporarily reduce amounts, flexible lenders work with you to keep accounts current.

Responsible Lending and Financial Guidance

Financial solutions that prioritize your future stability create lasting value. Reputable providers like Magical Credit focus on sustainable agreements rather than quick approvals. Their team reviews applications through a lens of financial wellness, ensuring borrowers avoid cycles of debt.

Ensuring Your Repayment Ability

Lenders analyze income stability using advanced verification methods. Magical Credit examines bank deposits for six consecutive months, even accepting government assistance as valid income. This approach helps determine comfortable payment ranges without straining budgets.

Debt-to-income ratios play a critical role. Providers compare your existing obligations against potential new payments using this formula:

| Calculation | Example |

|---|---|

| Monthly debts ÷ Gross income | $900 ÷ $3,000 = 30% |

Most lenders cap ratios at 40% to protect borrowers. Educational tools like payment calculators help applicants visualize how different terms affect their budgets.

Building a Positive Credit History

Timely payments become stepping stones toward financial recovery. Magical Credit reports to Equifax and TransUnion, turning each installment into a credit-building opportunity. One borrower shared: “My score jumped 58 points in seven months through consistent payments.”

Support systems reinforce success. Many lenders offer:

- 7-day grace periods for late payments

- Free financial counseling sessions

- Rate reductions for automatic payments

These practices help rebuild trust with traditional institutions. Over time, improved scores can unlock better rates on mortgages or car financing. As one advisor notes: “Responsible borrowing today plants seeds for tomorrow’s opportunities.”

Real Customer Experiences

Personal stories often reveal what numbers can’t. Borrowers across the country share how modern financial services helped them regain control during tough times. Their journeys highlight practical solutions and human-centered support.

Turning Challenges Into Opportunities

Sarah from Toronto needed $1,200 for emergency dental work. “The whole process took less time than my root canal,” she jokes. Her funds arrived within 4 hours through Interac e-Transfer. Two years later, her consistent payments helped boost her credit score by 112 points.

| Situation | Solution | Outcome |

|---|---|---|

| Medical emergency | $3,000 approved in 30 minutes | Saved $800 in late fees |

| Car breakdown | Same-day $950 repair loan | Kept employment |

| Credit rebuilding | 12-month payment plan | +58 credit score |

James, a single father in Vancouver, shares:

“They approved me for $500 more than I requested – exactly what the mechanic actually charged.”

His story reflects lenders’ commitment to meeting real needs rather than arbitrary limits.

Service quality shines in these reviews. One borrower notes: “The team answered all my questions before I even asked.” Another praises weekend availability: “Money hit my account Sunday night – no banks were open!”

These experiences demonstrate how timely support creates lasting change. From unexpected bills to credit recovery journeys, personalized solutions make financial stability achievable.

Additional Loan Options and Services

Financial needs vary, and modern lenders understand that one size doesn’t fit all. Beyond emergency cash solutions, many providers offer specialized products tailored to specific goals and life stages.

Personal and Business Loans

Need funds for car repairs or a creative project? Lenders provide personal loans for everything from kitchen remodels to educational expenses. Magical Credit offers installment options between $1,500 and $20,000 – perfect for debt consolidation or starting a small business.

Entrepreneurs appreciate flexible business financing. Whether launching a startup or expanding operations, customized amounts help bridge gaps without draining savings. One borrower used a $12,000 loan to upgrade their food truck, doubling monthly revenue.

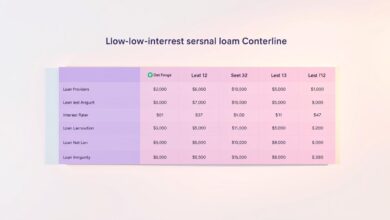

Competitive Rates and Terms

Today’s market delivers surprisingly affordable rates, starting at 3.9% for qualified applicants. Unlike traditional payday loans, these agreements feature transparent terms and payment schedules matching your budget.

Options include short-term cash advances ($100-$1,500) for urgent needs and multi-year plans for larger investments. Lenders review each request individually, considering factors like income stability and repayment history to craft fair offers.