Signature Loans: Unsecured Personal Loans Online

Need funds without the stress of collateral? Modern financial solutions now let you secure money quickly through streamlined digital processes. These unsecured options have transformed borrowing by cutting paperwork and wait times, making them ideal for urgent expenses or planned purchases.

Many lenders today prioritize speed and convenience. Complete your application in minutes from home, avoiding bank queues. Approval decisions often come within hours, with funds transferred electronically to your account. This approach works well for debt consolidation, medical bills, or home upgrades.

Your credit history still plays a role in determining rates and terms. However, competitive lenders focus on overall financial health rather than just scores. Transparent fee structures help you compare offers easily, ensuring you find terms that match your budget.

Key Takeaways

- No collateral required for approval

- Digital applications take under 10 minutes

- Funds often arrive same-day via e-transfer

- Flexible use for emergencies or planned expenses

- Credit profile affects interest rates

Understanding Signature Loans

When you need financial flexibility without risking assets, certain borrowing options stand out. These arrangements let you access funds based on trust in your repayment ability rather than physical guarantees. Let’s explore how they work and compare to traditional secured options.

What Are Signature-Based Financing?

A personal loan of this type uses your credit history and income as primary approval factors. Lenders evaluate your debt-to-income ratio and employment stability since there’s no collateral to claim if payments stop. Typical amounts range from $1,000 to $100,000, with repayment schedules spanning 1-7 years.

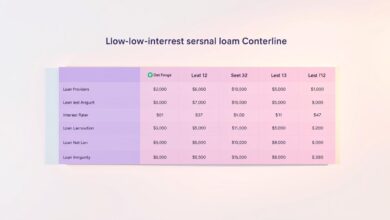

Collateral-Free vs Asset-Backed Options

Unsecured agreements protect your possessions but often have higher rates. Secured alternatives like home equity lines offer lower interest but require property pledges. Consider this comparison:

| Feature | Unsecured | Secured |

|---|---|---|

| Collateral Needed | No | Yes |

| Approval Speed | 24-48 hours | 3-7 days |

| Interest Rates | 6-36% | 3-18% |

| Risk Level | Lower asset risk | Higher asset risk |

This table shows why many choose unsecured options for urgent needs or smaller amounts. Always verify rate terms before committing, as your credit profile directly impacts offers. Use these loans strategically to consolidate high-interest debt or handle unexpected costs without jeopardizing valuables.

Benefits of Unsecured Personal Loans Online

Modern financial solutions prioritize speed and security while eliminating traditional barriers. These digital-first options let you address financial needs without complex requirements or physical meetings.

No Collateral Requirement

Your possessions stay safe throughout the borrowing process. Unlike secured options, approval depends on credit history and income verification rather than property pledges. This makes these arrangements ideal for renters or those protecting family assets.

Flexible amounts match various needs – from covering emergency repairs to funding career advancement courses. You maintain full ownership of vehicles, jewelry, and real estate while repaying the balance.

Quick Approval and Fast Access to Funds

Digital platforms operate round-the-clock, letting you apply during lunch breaks or late-night hours. Advanced systems analyze your financial profile instantly, often providing decisions within 15 minutes.

Once approved, funds typically arrive via e-transfer in 2-4 hours. Compare this to traditional options:

| Feature | Online Loans | Bank Loans |

|---|---|---|

| Application Time | 5-10 minutes | 30+ minutes |

| Approval Speed | Minutes | 3-5 days |

| Funds Availability | Same day | Next week |

| Document Upload | Digital portal | In-person/email |

Secure portals protect your data with bank-grade encryption. Always compare multiple offers to find rates that align with your budget. Many lenders provide payment calculators to help plan repayments before committing.

The Simple Online Application Process

Getting financial help shouldn’t feel like running a marathon. Modern lenders have streamlined applications to make borrowing stress-free. You’ll need basic details and a stable internet connection – no paperwork or office visits required.

Filling Out the Secure Application Form

Start by entering your personal loan request amount and repayment preferences. The system asks for employment information, income verification, and banking details. Real-time checks alert you if numbers don’t match public records, saving time.

Secure portals use 256-bit encryption – the same protection banks employ. Your social security number and financial information stay private throughout the process. Most people finish in 10-15 minutes while watching TV or waiting for coffee.

Expert Review and Prompt Cash E-Transfer

Specialists verify your details using automated systems and human oversight. They check:

- Employment status via secure employer portals

- Bank balances through read-only access

- Credit history without hard inquiries

Approval decisions typically arrive within 4 hours. Funds reach your account faster than ordering pizza:

| Step | Online Process | Traditional Process |

|---|---|---|

| Form Completion | 12 minutes | 45 minutes |

| Review Time | 4 hours | 3 business days |

| Funds Transfer | 2 hours | 5-7 days |

Need help? Chat support guides you through each stage. They’ll explain terms or fix typos – no judgment, just solutions. Once approved, your personal loan arrives electronically, ready for emergencies or opportunities.

Loan Terms, Rates, and Payment Options

Understanding your loan’s financial details helps you save money and avoid surprises. Let’s break down how interest works, repayment timelines, and strategies to match payments with your budget.

Fixed vs. Variable Rate Choices

Fixed rates stay constant throughout your repayment period. This stability makes budgeting easier since your monthly payment never changes. For example, a $10,000 loan at 8% fixed interest would have identical payments for five years.

Variable rates shift with market conditions, often tied to benchmarks like the Bank of Canada’s Overnight Rate. While starting lower than fixed options, they can rise over time. “Variable rates work best for short-term borrowing or when you expect rates to drop,” notes a financial advisor from RBC.

Customizable Repayment Plans

Most lenders offer terms from 12 to 60 months. Shorter terms mean higher monthly payments but lower total interest costs. Longer timelines reduce immediate strain but increase overall expenses.

Flexible schedules let you align payments with paydays. Choose:

- Bi-weekly plans matching paycheck deposits

- Monthly options for consistent budgeting

- Accelerated payments to reduce interest

Automatic payment discounts and loyalty rewards can lower your rate by 0.25-0.5%. Always use payment calculators to compare scenarios – even a 1% rate difference could save $500 on a three-year $15,000 loan.

Managing Debt and Credit with Signature Loans

Smart financial strategies turn borrowing into opportunities for growth. When used wisely, these tools help streamline obligations while strengthening your financial foundation. Let’s explore practical methods to optimize repayment plans and boost credit health.

Effective Payment Management Strategies

Consolidating high-interest balances simplifies your financial life. Combining multiple debts into one fixed-rate payment often lowers overall interest costs. Many lenders allow extra payments without fees, letting you reduce the total amount owed faster.

| Strategy | Benefit | Impact |

|---|---|---|

| Automatic payments | Avoid late fees | +40 credit score points* |

| Bi-weekly schedule | 26 payments/year | Save 8% interest |

| 5% extra monthly | Pay off 2 years early | $1,200 saved |

*Based on FICO data for consistent on-time payments

Building a Strong Credit Profile

Your credit history grows stronger with diverse account types. Installment loans demonstrate responsible long-term planning when paired with low credit card utilization. Regular monitoring helps catch errors affecting your score.

Key actions for improvement:

- Review reports quarterly at AnnualCreditReport.com

- Keep revolving balances below 30% of limits

- Maintain 2+ active credit types

Budgeting tools from your lender can align payments with income cycles. Remember: every on-time payment builds trust with future creditors. A $15,000 personal loan paid responsibly often improves scores more than maxed-out cards.

Conclusion

Navigating financial needs has never been more straightforward with today’s digital lending solutions. These tools offer a practical way to secure funds for everything from car repairs to home renovations, all while protecting your assets. The streamlined online process delivers competitive rates and flexible terms, often surpassing traditional banking options.

Consider optional insurance add-ons like payment protection or disability coverage for extra security. While helpful, evaluate their costs against potential benefits. Borrowers can access up to $200,000 without collateral, though using home equity might secure better rates for larger amounts.

Always compare multiple lenders – slight differences in payments or fees can save hundreds over time. Tools like automatic payment calculators help match loan terms to your budget. Building credit through timely repayments opens doors to future financing for major purchases.

Ask questions and review all details before committing. While these financial solutions simplify borrowing, success comes from pairing convenience with smart planning. Your next step? Explore options confidently, knowing you’ve got the information to make empowered choices.