Small Business Loans: Fast Funding Solutions Available

Growing your venture requires resources that match your ambition. Today’s entrepreneurs have more pathways than ever to secure essential capital, with streamlined processes that prioritize speed without sacrificing clarity. Whether you’re aiming to upgrade equipment or manage seasonal cash gaps, modern financing solutions adapt to diverse operational needs.

The U.S. Small Business Administration plays a pivotal role by partnering with lenders to reduce risk. Through these collaborations, approved institutions offer structured programs that combine competitive rates with flexible terms. This system empowers owners to focus less on paperwork and more on strategic growth.

We’ll simplify the landscape of available loan options, from government-backed initiatives to alternative platforms prioritizing rapid approvals. You’ll learn how to align your unique circumstances with the right funding strategy, whether you need immediate working capital or long-term investment support.

Key Takeaways

- SBA partnerships help lenders offer accessible financing with favorable terms

- Multiple funding sources exist beyond traditional bank loans

- Digital platforms accelerate approval timelines for urgent needs

- Loan processes now prioritize user-friendly documentation

- Strategic financing aligns with specific growth milestones

Understanding these opportunities transforms how you approach expansion challenges. Let’s explore how to navigate this dynamic environment with confidence and precision.

Introduction to Small Business Loans

Accessing capital quickly transforms challenges into growth opportunities. Modern entrepreneurs benefit from evolved funding strategies that balance speed with practicality. Let’s explore how tailored solutions address everything from equipment upgrades to seasonal cash flow gaps.

Overview of Funding Solutions

Today’s financial landscape offers multiple pathways beyond conventional bank options. Government-backed programs, like those from the SBA, provide extended repayment terms and lower collateral demands. These initiatives help ventures that struggle with traditional approval criteria.

| Loan Type | Approval Time | Key Benefit | Collateral |

|---|---|---|---|

| Traditional Bank | 4-6 weeks | Lowest rates | High |

| SBA 7(a) | 2-3 weeks | Flexible terms | Reduced |

| Alternative Online | 1-2 days | Immediate access | Variable |

Why Fast Funding Matters for Your Business

Delayed decisions cost revenue. When market conditions shift, rapid financing lets you hire staff, restock inventory, or adopt new technologies ahead of competitors. A 2023 industry report found ventures securing funds within 72 hours grew 34% faster than those waiting weeks.

Seasonal peaks and unexpected expenses demand agility. Quick approvals turn potential setbacks into strategic wins. Aligning your needs with the right program builds momentum for sustainable success.

Exploring Fast Funding Solutions

Speed in securing capital often separates industry leaders from competitors. Modern programs bridge gaps between opportunity and action, offering tailored support for time-sensitive goals. Whether expanding operations or addressing unexpected costs, strategic financial tools keep momentum alive.

How Quick Financing Can Propel Growth

Timely access to funds transforms ideas into revenue streams. A 2023 industry study revealed ventures using rapid credit options secured 28% more market share during expansion phases. Programs like Bank of America’s Preferred Lenders Program cut approval wait times from weeks to days, letting you act when opportunities arise.

Consider inventory purchases during supplier discounts or hiring seasonal staff. Delayed funding risks missing these windows. Fast-tracked decisions maintain operational agility, turning potential setbacks into measurable gains.

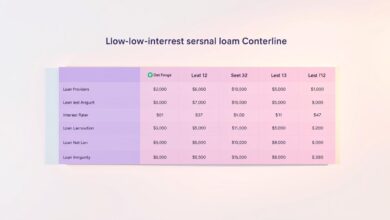

Comparing Loan Programs for Immediate Needs

Not all credit options work equally for urgent scenarios. Below is a breakdown of popular choices:

| Program | Speed | Minimum Amount | Best For |

|---|---|---|---|

| Traditional Banks | 4-6 weeks | $50,000 | Long-term projects |

| SBA PLP | 5-7 days | $25,000 | Equipment upgrades |

| Online Lenders | 24-48 hours | $10,000 | Emergency cash flow |

Alternative platforms excel for urgent needs under $50k, while SBA-backed options balance speed with favorable rates. Assess your timeline and requirements to match the right solution.

Types of Loan Programs for Your Business

Navigating funding options requires understanding key program differences. Government-backed initiatives and alternative platforms each serve distinct operational needs. Let’s break down how these solutions address everything from major purchases to urgent cash flow gaps.

SBA 7(a) Loans and Microloans

The Small Business Administration’s 7(a) program supports diverse purposes, from upgrading machinery to refinancing debt. Borrowers can access up to $5 million with repayment terms stretching 25 years. “This program remains our top recommendation for ventures needing adaptable capital,” notes a senior SBA advisor.

Microloans fill specific gaps, offering up to $50,000 through nonprofit lenders. These funds often help with inventory restocking or minor equipment upgrades. Combined with mentorship programs, they create stepping stones for early-stage companies.

| Program | Best Use Cases | Loan Range | Approval Time |

|---|---|---|---|

| 7(a) Loans | Expansion, Equipment | $50k-$5M | 2-4 weeks |

| Microloans | Inventory, Small Upgrades | Up to $50k | 7-10 days |

| CDC/504 Loans | Real Estate, Heavy Machinery | $125k+ | 4-6 weeks |

Alternative Financing Options

Digital lenders now provide specialized programs for faster access. Revenue-based financing ties repayments to monthly earnings, while equipment loans use purchased assets as collateral. These solutions often approve applications within 48 hours.

Merchant cash advances work well for retailers needing instant working capital. Though costlier than traditional options, their speed proves invaluable during seasonal crunches. Always compare total repayment amounts against projected revenue gains.

Key Features of SBA-Backed Loans

SBA-backed financing stands apart through unique structural advantages that benefit growing ventures. These programs blend affordability with adaptable frameworks, helping owners manage cash flow while pursuing strategic goals.

Competitive Rates and Flexible Terms

Interest rates on these loans frequently match or outperform conventional options. Government backing allows lenders to offer extended repayment timelines – some stretching 25 years – without demanding hefty upfront payments.

Many programs eliminate collateral requirements entirely for smaller amounts. This removes a common obstacle for ventures with strong revenue but limited physical assets. Borrowers also avoid restrictive clauses that limit operational flexibility.

Support, Counseling, and Unique Benefits

Beyond funding, SBA partners provide mentorship through local resource centers. “Our clients gain access to templates for financial projections and market analysis tools,” explains a regional development director.

Educational workshops cover topics like inventory management and digital marketing. This holistic approach helps owners make informed decisions, turning capital injections into sustainable growth engines.

Eligibility and Requirements for Funding

Securing financial support starts with understanding key criteria that determine qualification. Programs prioritize ventures that demonstrate responsible management and clear growth potential. Let’s break down what lenders evaluate before approving applications.

Legal and Credit Requirements

Proper registration forms the foundation of eligibility. Your venture must maintain current licenses and comply with local regulations. This applies to both brick-and-mortar locations and online operations.

Credit evaluations focus on repayment capacity rather than flawless history. A 2023 SBA report showed 41% of approved applicants had credit scores below 680. Lenders prioritize consistent revenue streams and realistic growth projections.

Business Size and Operational Standards

Size standards vary across industries but aim to support ventures needing assistance most. For example, manufacturing companies can employ up to 500 workers, while retail firms typically cap at $8 million annual revenue.

Operations must contribute to domestic economic activity. This means headquarters and primary facilities reside within U.S. territories. Funds must fuel legitimate objectives like expanding production capacity or upgrading technology systems.

Demonstrating repayment ability involves showcasing cash flow patterns and debt management strategies. Lenders appreciate detailed plans linking borrowed capital to specific profitability milestones.

small business loans: Evaluating the Best Options

Choosing the right financial partnership requires careful analysis of how programs align with your operational goals. Each institution structures its offerings differently – Wells Fargo’s BusinessLine caters to ventures with two+ years of activity, while their Small Business Advantage program supports newer endeavors.

Assessing Program Variations

Credit history and revenue patterns heavily influence approval odds. Established ventures often qualify for lower rates, while startups might need collateral alternatives. Industry specialization matters too – agricultural lenders may offer better terms for farms than generalist institutions.

Consider this comparison when exploring options:

| Institution | Minimum Operational History | Key Advantage |

|---|---|---|

| Wells Fargo | 2 years | Higher credit limits |

| Bank of America | 6 months | Fast-track renewals |

| Online Platforms | None | 24-hour approvals |

Aligning Requirements with Objectives

Documentation needs vary widely. Traditional banks might request tax returns and business plans, while digital lenders focus on bank statements. “The strongest applications directly connect funding use to measurable growth,” advises a financial consultant at Lendio.

Compare annual percentage rates (APR), repayment schedules, and prepayment penalties. Some programs include free financial tools – a valuable bonus for budgeting support. Prioritize flexibility if market conditions might shift your needs.

The Application Process and Approval Steps

Streamlining your funding journey begins with a clear roadmap. The SBA Lender Match platform simplifies initial steps by connecting ventures with compatible financial partners. This system reduces guesswork while maintaining control over your timeline.

How to Get Started with Lender Match

First, review loan types matching your objectives. Enter basic details like funding amount and intended use into the Lender Match portal. Creating an account takes minutes and triggers instant alerts to participating institutions.

Interested lenders typically respond within 48 hours. “This service cuts weeks off traditional search processes,” notes a financial advisor from the SBA Resource Partner Network. Prepare to discuss cash flow patterns and growth plans during initial consultations.

Documentation and Timeline Overview

Gather tax returns, profit statements, and legal paperwork early. Most programs require three years of financial history, though newer ventures can substitute projections. Digital platforms often accept bank-verified data instead of physical copies.

Approval time varies:

- Standard SBA loans: 2-4 weeks

- Preferred Lender Program: 5-7 days

- Emergency lines of credit: 72 hours

Submitting complete information upfront prevents delays. Regular communication with your chosen institution keeps everything on track.

Tips for Working with SBA-Approved Lenders

Building strong partnerships with financial institutions requires preparation and insight. Trustworthy lenders prioritize transparency, but knowing how to navigate discussions ensures you secure optimal terms for your goals.

Smart Strategies for Rate Discussions

Business credit strength often determines your leverage. If your venture shows consistent revenue, propose competitive interest rates aligned with market averages. Many institutions adjust terms for borrowers offering collateral or shorter repayment windows.

Always compare annual percentage rates (APR) instead of basic rate figures. This reveals hidden costs like origination charges or prepayment penalties. Reputable lenders provide full fee breakdowns upfront – a red flag if omitted.

Watch for institutions demanding fees exceeding 5% of your line credit amount. Legitimate options disclose payment schedules clearly. Ask detailed questions about processing timelines to avoid surprises during final approvals.

Strengthen negotiations by showcasing cash flow stability or growth projections. Some banks reward organized applicants with faster access to funds or reduced documentation. Remember: A favorable agreement supports both immediate needs and long-term financial health.