Streamline Your Financial loan application Process

Getting the right financial support shouldn’t feel like solving a puzzle. Whether you’re consolidating debt or funding a business project, modern solutions make it easier than ever to access funds quickly. Today’s lenders offer unsecured options with no collateral required, giving you flexibility without risking personal assets.

Most providers now deliver decisions within hours and funding in as little as one business day. Amounts range from $1,000 to $100,000, with repayment terms spanning 1-7 years. Your credit profile plays a key role in determining rates, which typically fall between 8% and 25% APR for qualified borrowers.

Online platforms have revolutionized how people approach financial planning. Many let you check eligibility instantly without affecting your credit score. This transparency helps you compare offers confidently while avoiding application fatigue.

Key Takeaways

- Modern lenders provide same-day decisions and next-business-day funding

- Loan amounts range from $1k to $100k with flexible 1-7 year terms

- APR typically falls between 8%-25% based on creditworthiness

- Online tools enable pre-qualification without credit score impacts

- No collateral required for most personal financial solutions

- Compare multiple offers to secure optimal rates and terms

Understanding the Loan Application Process

Knowing what lenders expect helps you prepare better for securing funds. While every provider has unique standards, most follow similar guidelines to evaluate requests. Let’s break down what you need to succeed.

Overview of Eligibility and Requirements

Basic qualifications include being a U.S. citizen or permanent resident aged 18+. You’ll need a valid Social Security number and physical address. Most providers require proof of steady income – typically $25,000+ annually – through pay stubs or tax documents.

Digital access is essential since modern financial solutions rely on online platforms. You’ll need an email account and smartphone or computer to complete the process smoothly.

Factors That Impact Your Approval

Your credit score acts like a financial report card. Scores above 740 often unlock premium rates, while those near 660 may face higher costs. Lenders also review your debt-to-income ratio, preferring it to stay under 40% for manageable payments.

Recent activity matters too. Multiple new credit inquiries might raise concerns about overextension. Stable employment history – ideally two years in your current role – shows reliability. Always double-check your application details, as errors can delay decisions.

Key Considerations for a Streamlined Process

Smart financial planning starts with understanding the key factors that shape your options. Let’s explore how to position yourself for success by managing critical elements lenders evaluate.

Role of Credit History and Score

Your credit history acts like a financial diary, showing how you’ve managed past obligations. Lenders examine payment consistency, account longevity, and mix of credit types. Scores above 800 often unlock rates below 8% APR, while scores between 660-739 typically see mid-teens percentages.

| Credit Tier | APR Range | Key Features |

|---|---|---|

| Excellent (800+) | 7.99% – 10% | Lowest rates, flexible terms |

| Good (660-799) | 11% – 18% | Competitive offers |

| Fair (580-659) | 19% – 25% | Higher oversight |

Managing Income, Debt, and Other Factors

Lenders review your total financial picture, not just salary. Bonuses, freelance work, and rental income can strengthen your case. Aim for a debt-to-income ratio below 40% by paying down balances before applying.

Recent credit checks matter too. Space out financial requests by 30-45 days to avoid multiple hard inquiries. Consistent employment history and error-free paperwork keep your profile polished.

Benefits of a Simplified Loan Application

Modern financial solutions have transformed how we access support when life throws curveballs. Whether you’re covering unexpected expenses or expanding a business, streamlined systems put speed and clarity at your fingertips.

Quick Approval and Fast Funding

Gone are the days of waiting weeks for answers. Top providers now deliver decisions within hours – some even offer instant pre-qualification. Once approved, funds often arrive in your account by the next business day if you apply during weekday hours.

This rapid turnaround makes personal loans ideal for urgent needs like emergency repairs or time-sensitive opportunities. Just ensure your paperwork is complete and accurate to avoid delays. Electronic transfers eliminate check-clearing waits, getting money where it needs to go fast.

No Hidden Fees and Flexible Terms

Transparency separates modern financial tools from old-school options. Leading lenders skip origination fees, prepayment penalties, and surprise charges. You’ll know exactly what you’re paying from day one.

Repayment terms adapt to your situation, with options spanning 1-7 years. Need smaller monthly payments? Choose a longer timeline. Want to save on interest? Opt for shorter terms. This flexibility helps both growing businesses and individuals balance budgets effectively.

As one financial advisor puts it: “The best solutions work with your life, not against it.” With clear fee structures and customizable plans, you can focus on your goals instead of fine print.

How to Compare Lenders and Rates

Finding the best financial partner starts with smart comparison strategies. Not all lenders operate the same way, and subtle differences can save you thousands over time. Let’s explore what separates good offers from great ones.

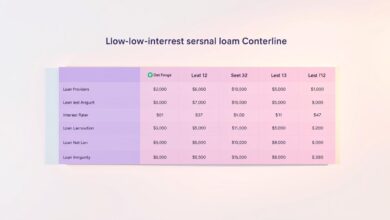

Evaluating APR, Fees, and Loan Amounts

The annual percentage rate (APR) tells the full story of borrowing costs. Major banks like Wells Fargo offer rates as low as 6.74%, while others hover near 25% for similar amounts. Your credit profile directly influences where you land in this range.

| Lender | APR Range | Amount Limits | Special Features |

|---|---|---|---|

| Discover | 7.99% – 24.99% | $2,500 – $40k | 0.25% autopay discount |

| U.S. Bank | 7.99% – 24.99% | $1k – $50k | Free credit score access |

| Wells Fargo | 6.74% – 23.99% | $3k – $100k | Relationship rate discounts |

Look beyond advertised rates. Some lenders charge origination fees up to 6%, while others skip these costs entirely. Always calculate the total repayment amount before committing.

Amount flexibility matters too. While most providers start at $1,000, high-limit options reach $100k for qualified borrowers. Match your needs to lender thresholds – borrowing less than $3k might limit your options.

Don’t overlook perks like payment date adjustments or automatic discounts. As one banking expert notes: “The right benefits package can outperform a slightly lower rate.” Compare all features side-by-side to maximize value.

Navigating Terms, Rates, and Payments

Mastering financial agreements requires clarity on how costs accumulate over time. Whether you’re budgeting for home improvements or managing debt, understanding rate structures and repayment math empowers smarter decisions.

Understanding Fixed vs. Variable Interest Rates

Fixed rates lock in your percentage for the entire term. This stability shields you from market hikes – ideal for long-term planning. Most major providers use this model, with APRs ranging from 7.99% to 25% based on creditworthiness.

Variable rates fluctuate with economic indexes like the prime rate. While sometimes starting lower, they introduce uncertainty. As one banker warns: “Borrowers risk payment spikes if rates climb during their term.” Choose fixed options for predictable budgeting.

Calculating Monthly Payments and Total Costs

Your payment size depends on three levers:

- Amount borrowed: Higher sums increase both monthly and total costs

- Interest rate: A 5% difference can add thousands over seven years

- Term length: Extending timelines lowers payments but raises overall interest

Consider a $16,000 agreement at 12.99% APR over 36 months. You’d pay $539 monthly, totaling $19,404. Shorten the term to 24 months? Payments jump to $763, but you’d save $1,236 in interest.

| Term Length | Monthly Payment | Total Interest |

|---|---|---|

| 24 months | $763 | $1,712 |

| 36 months | $539 | $3,404 |

| 60 months | $364 | $5,840 |

Always factor in origination fees (0%-6%) and prepayment penalties when comparing offers. Tools like amortization calculators reveal true costs beyond advertised rates.

User-Friendly Application Strategies

Your path to quick approvals begins with preparation. Modern digital tools make submitting requests easier than ever, but success hinges on organization and attention to detail. Follow these proven methods to breeze through the process.

Online Application Tips and Best Practices

Gather these documents before starting:

- Recent pay stubs or tax returns

- Bank account details for direct deposit

- Government-issued ID

Use this checklist to avoid delays:

| Document Type | Purpose | Processing Time Impact |

|---|---|---|

| Employment Verification | Income confirmation | +24 hours if missing |

| Bank Statements | Account history review | +48 hours for non-electronic |

| Photo ID | Identity validation | Immediate halt if expired |

Complete forms in one sitting using a private Wi-Fi connection. Financial advisor Rachel Torres advises: “Treat digital submissions like in-person meetings – focused and interruption-free.”

Avoiding Common Pitfalls

Triple-check numbers and dates. A single typo in your account number or birthdate can add 3-5 business days to funding timelines. Space out requests to different providers by at least 30 days to protect your credit history.

Watch for these red flags:

- Forms requesting unnecessary personal content

- Websites without “https” security

- Lenders ignoring your preferred terms

Bank transfers to credit unions or neobanks might take 72 hours versus 24 hours for major institutions. Always confirm electronic deposit timelines with your provider.

Loan Application: Insider Tips for Fast Approval

Unlock faster funding with precision in your submission approach. Small oversights can create unnecessary delays, while strategic preparation keeps your request moving smoothly. Let’s explore how to position yourself for success from the first click.

Essential Steps to Submit Error-Free Applications

Triple-check every detail before hitting submit. Lenders cross-reference Social Security numbers, employer contacts, and income claims. A single typo in banking digits could delay funds by 3-5 business days. Use this verification checklist:

- Match pay stubs to stated earnings

- Confirm account numbers with bank statements

- Update expired government IDs

Selecting the right purpose matters. Requests to consolidate debt or fund home upgrades often receive better rates than vague “personal use” categories. Wells Fargo and similar institutions may require 12+ months of existing relationships for eligibility.

Time your submission strategically:

| Submission Time | Approval Speed | Funding Timeline |

|---|---|---|

| Weekday Morning | Same-Day Review | Next Business Day |

| Weekend | Monday Processing | 2-3 Business Days |

Keep tax returns and recent pay stubs handy for potential follow-ups. As financial expert Mia Rodriguez notes: “Complete documentation turns maybe into yes.” Electronic transfers to established accounts accelerate disbursement versus new banking connections.

Conclusion

Securing financial solutions has become more straightforward than ever with today’s digital tools. Modern lenders deliver same-day decisions and funds within 24 hours, offering competitive rates from 6.74% to 24.99% APR. Flexible repayment terms spanning 12-84 months let you align payments with your budget.

Smart borrowers maximize savings through relationship discounts and automatic payment perks. Many providers now offer fee-free programs that simplify cost management. These features help reduce total expenses while maintaining transparency throughout the agreement period.

Whether managing home upgrades or unexpected expenses, unsecured options provide versatile funding without collateral requirements. Your credit profile remains central to securing favorable conditions, making pre-qualification checks essential before committing.

By combining thorough preparation with strategic lender comparisons, you can access optimal terms that support your business or personal goals. Remember – organized documentation and rate shopping remain your strongest tools for financial success.